Covid-19 Recovery: Webinar Insights for Businesses

Details

In this section, we compiled insights from the various webinars that were taking place from March to July 2020 as a reaction to the global coronavirus pandemic. The insights below provide an archive of key insights that you can use to look back where the discussion around Covid-19 and its impact on inclusive businesses started and how it evolved.

Also, find here an analysis provided by iBAN on how the Covid-19 response in Africa has developed “From Rescuing to Reshaping”.

Take a look at each webinar

- Impact Investing Institute: Finding Hope in Crisis: Building Back Better After Coronavirus

-

Date: 3 June 2020

Organised by: Impact Investing Institute

Facilitator: Sarah Gordon, CEO at the Impact Investing Institute

Panel Members:

- Richard Curtis, Co – Founder at Make My Money Matter

- Amanda Young, Global Head of Responsible Investment at Aberdeen Standard Investments

Description:

The panel members stress the importance of pension funds to increase their engagement in impact investments. They see companies that act responsibly and provide solutions for urgent problems of our society as the best solution if investors are looking for safe long-term returns.

Key Insights:

- “Don’t only watch your carbon footprint, also watch your financial footprint.”

- Everyone sits on money for their pensions. If these funds could be leveraged, people could do good while investing their money.

- Every investment has an impact: either a positive or a negative. Impact Investment at Aberdeen Standard offers different ranges of impact investment: Avoiding harm; creating benefits for the stakeholders; actively working on solutions.

- Investing in solutions that solve problems offers a great potential for future returns. There are many problems that affect a large potential market.

- Three major challenges for our society: Environmental changes; growing inequalities; unsustainable production and economy.

- 51 percent of people (70 percent of young people) want their pensions to be ethical. Many people state, that they would invest more in their pensions, if they knew, they were ethical. See an overall rise in demand for impact investment.

- Pension funds should actively address potential clients with offers of responsible investment and not wait for them to approach them.

- Corona crisis highlights many problems in our society and people become more aware of these problems.

- Impact Investing did not just gain track because of Covid-19 but before that already. Companies that treat their employees well and have a sustainable business model, are more resilient and will outperform other companies in the long-run, which is perfect for pension funds.

- ANDE: Investing with Impact during Covid-19

-

Date: 28 May 2020

Organised by: ANDE

Facilitator: Sekai Chiwandamira (ANDE)

Panel Members:

- Heather Jackson; Specialist Credit Reporting ASHBURTON Investments

Description:

Blended Finance solutions/public instruments to de-risk investments are what is needed to keep impact investments stable during the crisis, and maybe beyond. Heather Jackson explains how these instruments could look like and shares insights from South Africa.

Key Insights:

Description of current situation:

- Large amount of SGBs is in high risk of failure.

- Need for finance solutions for SGBs.

- SGBs need non – financial support to adapt to non – Covid world.

R3 Coalition (Response, Recovery and Resilience) established to address:

- Crisis highlights trends of social inequality.

- Need policy to drive social inclusion and growth.

- Blended finance as a strong instrument to fight market problems.

Increase in interest in impact investing concerning agri-food systems but also new areas such as innovative new business models that improve peoples’ livelihoods (decentralized distribution of goods).

What does successful usage of blended finance look like?

- Partnership with public sector.

- Catalytic capital to leverage resources.

- Multilingual leadership (like at ANDE); bringing together different groups involved in the sector.

- Financial AND social returns are realized at the same time.

Blended Finance: Guarantee Mechanisms as most promising tool to address credit market failure for SGBs.

- “The Jobs Fund” in South Africa as a good example. Together with Ashburton Investment “The Jobs Fund” set up a funding vehicle that invested in SGBs and received capital from pension funds and corporate investors.

Sustainability of guarantee mechanisms depends on:

- Effective collaboration and partnership with a capable public sector.

- A robust and efficient accountability framework that targets impact outcomes.

“We have to test new models and stop scaling ones that are not successful.”

How are social returns measured? Many measurement tools (e.g. IRIS Indicators; Impact Measurement Project) that one can apply but there is not one answer.

Uncertainty on how long the crisis persists and the overall consequences depend on the length of the lockdowns. For many countries this is the opportunity to push through legislation that is needed for the future.

Technical assistance is very important, and many impact investors are looking into it as part of their efforts.

- GSG Webinar – Impact driven policy responses to the Covid-19 crisis

-

Date: 14 May 2020

Organised by: GSG

Facilitator & Panel Members:

- hosted by Sir Ronald Cohen, GSG Chair;

- Cliff Prior, CEO Elect,

- and Sebastian Welisiejko, Chief Policy Officer.

Description:

GSG, is an independent institution working in 32 countries advocating for impact investment. The GSG’s first ever open Webinar to discuss action-oriented impact policy responses to the Covid-19 crisis. This discussion will presented the evolution in the thinking and design of adequate impact-driven responses to the crisis, including a retrospective of other global crises, an overview of various impact instruments best suited to different phases of the crisis; and the need for a reinterpretation of impact in the current context.

Key Insights:

Welisiejko Chief Policy Officer:

- Global pandemic brought to surface the systemic weaknesses

- The crisis has an even stronger impact on the most vulnerable

- Work towards a construction of a new normal and not return to the status before as this would be a step back

- No SDG is untouched through COVID

- Impact investment adds a third dimension: risk, return and impact

- What does the public sector do to emerge more resilient?

- Solutions need to be tailored to different realities of different countries

- Resiliency and recovery fund for social actors and charity organisations

- Impact emerges as central objective during government interventions (Forbidden aid for offshore in tax haven listed companies, prevention of dividend payments for companies that receive aid)

- High future costs through drop-out rates of pupils increase. Especially low income countries will experience problems.

- Emergency – Recovery – Renewal: in every phase of the crisis the perspective on investment perspective will change

- A framework for impact policies:

- Income inequality increasing globally and will increase even further if nothing is done.

Sir Ronald Cohen

- Inequality problems arise from economical system and not from political system. Taxes can never achieve what the private sector can achieve in cooperation with political leaders by establishing sound and fair practices.

- Coming out of this crisis, we will have similar situation as in 1930s. Likely to come out with high unemployment, government indebtedness through excessive stimulus.

- Need to come out of the crisis with a system of measuring a company’s impact.

- If stimulus packages ignore vulnerable parts of the populations, we will have a even broader inequality and potential political unrest.

- NGOs and Charities are threatened in their existence because philanthropists and impact funds have to focus on their own portfolio – Need green and social bonds.

- Innovation bonds to fund companies that are working on testing is a good example of the kind of investing needed now.

- Governments need to focus on education: Education of pupils but also professional education of newly unemployed.

- Big Society capital a good example of wholesale investment vehicle.

- We have to come out of this crisis with government understanding that companies have to measure their impact in a reliable way.

- Chance to bring companies and investors at the side of the government.

- Short Term: Innovation Bonds for testing and vaccine development; Long Term: effective impact measurements need to be established as a norm!

Cliff Prior:

- What gets measured gets done: We need to introduce broad scale frameworks for impact management. All countries have signed the SDGs and thereby we have a minimum framework.

- Having an institution that can act flexible and agile in distribution impact funds such as Big Society Capital in supporting the community.

- Wholesaler can broaden the market and can be a beacon for impact investment.

- Have to bring impact investing to the broad finance community. Entrepreneurs will pop up after the crisis and we can make sure that these initiatives are directed to the right directions.

- We are the agents of change who can influence the outcomes of the crisis

- American University of Cairo Gerhart Center: A new Age of Sustainable Capitalism

-

Date: 13 May 2020

Organised by: American University of Cairo Gerhart Center

Facilitator: Moderator Tarek Selim

Panel Members:

- Stuart L.Hart – Fellow in Sustainable Business University of Vermont Founder BoP Global Network; President Enterprise for a sustainable World

Description:

Stuart Hart discusses his research on sustainability aspects in capitalism. He believes that big disruptions of the economy (as experienced now through COVID – 19) are the starting point for new ideas. These new ideas often have been hovering around already before the crisis but experience an acceleration through these disruptions. A bigger focus on CSR, social entrepreneurship, inclusive business and sustainability could be the outcome of the COVID -19 disruption.

Key Insights:

- Last great disruption of similar magnitude as COVID: 1970s OPEC Oil crisis

- Disruptions give rise to ideas already present but not enforced

- After disruption of 1970 shareholder primacy rose to central focus of businesses. Now countervailing forces appear (sustainable finance, Sustainable innovation, clean technology, CSR, Green New Deal, BoP, Inclusive Business…)

- “Get investors off the backs of corporations” – is the solution really that simple?

- It is not! Targets help companies to be financially sustainable in the long term and detect bad management. Investors also look at opportunity in the future and are willing to neglect short term profits for long term profits (example Facebook/AirBnB/WeWork).

- Redefining what value really means will be the big topic after covid.

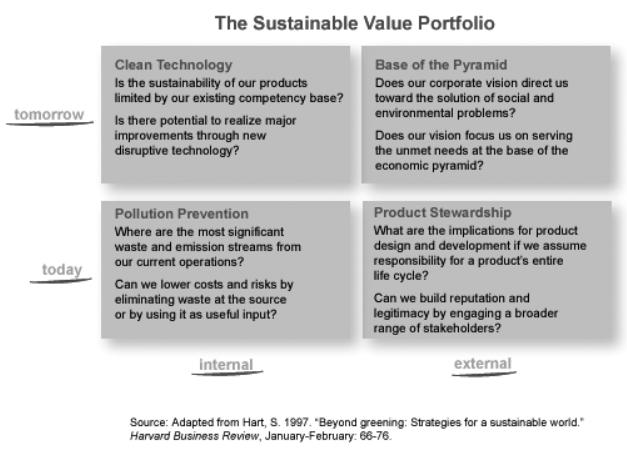

- Sustainable Value Portfolio (Hart,1997)

- Environmental and social responsibility are essential determinant of a companies long term success. A well managed company with a focus on shareholder values includes these aspects as a necessity.

- Corona Pandemic could mean the start into a new era of capitalism but not necesarilly. It depends on the choices we make now.

- Students and Graduates of today will join the economy with a different mindset. They will be the investors and shareholders of tomorrow and will look for sustainability aspects in their investment choices.

- IFC: Development Finance Institutions Response to Covid-19

-

Date: 8 May 2020

Organised by: IFC

Description:

The objective of this workshop is to fill some of the information gaps on responses of the private sector to the shock and highlight strategies for DFIs to be countercyclical in the current context as well as the recovery phase that will follow. The discussion will focus in particular on:

- Heterogeneous impact of pandemic on regions, countries, sectors, types of firms and activities.

- Positive and normative lessons learnt from previous epidemics, natural and manmade disasters.

- Information and knowledge shortcomings for designing DFI response strategies and assessing their effectiveness.

- Examples of promising private sector initiatives to contain transmission and mitigate effects of the pandemic, that DFIs could support.

- Innovative DFI instruments to use in the presence of field work restrictions.

- Complementarity of DFI response with stimulus packages and MDB lending to governments.

- Strategies to support recovery of the private sector after the crisis.

Session 1:

Heterogeneous Impact of Covid-19 to Firms, Activities, and Global Value Chains (GVCs)

Facilitator & Panel Members:

Moderator:

- Paddy Carter, CDC

Invited Interventions:

- Laura Alfaro, Harvard Business School

- Tarek A. Hassan, Boston University

- Sebastien Miroudot, OECD

- Christopher Woodruff, Oxford University and International Growth Centre

Key insights:

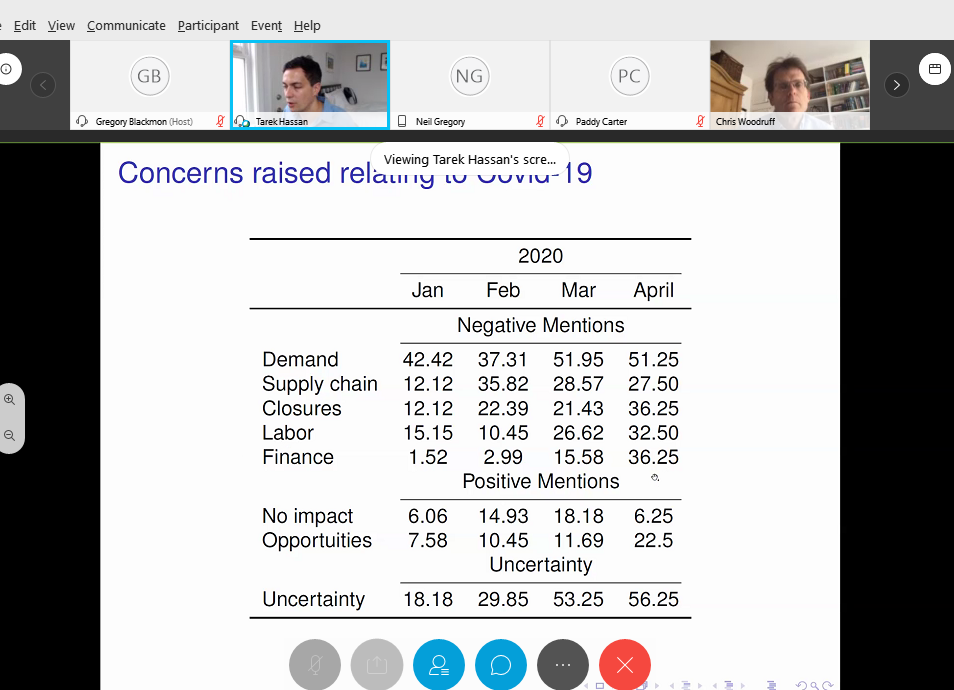

Tarek A. Hassan (Demand shock):

- Language analysis of firm conference calls (listed OECD firms announce their earnings – managing team explains results to analysist; www.firmlevelrisk.com).

- Find the full study here.

- Analisis showed increased importance of demand shock. Companies reacted on different time scales (airlines already discussed the consequences in early january).

- Uncertainty gained the highest relevance for companies.

Sebastien Miroudot (Importance of Logistics):

- Not all firms are impacted the same (heterogeneity).

- Positive demand effect on health sector; negative effect on others but with heterogenous causes.

- Differences across sectors and countries, due to direct effect (disease) or indirect (demand shock, supply chain linkages).

- How fast can we recover the international logistic infrastructure (trading goods and movement of people)? Fear of protectionism (export restrictions).

Christopher Woodruff:

- Disaster recovery usually in one location – rest of the world helps out with resources (now: recovery founds are not going to flow in).

- South Asia: exports textile industry –> demand shock.

- Sub-Saharan Africa: exports groceries –> supply chains are disrupted; demand is not affected as much -> how can supply chain issues be resolved?

Session 2:

Knowledge Gaps and Innovative Instruments to Support the Private Sector During and After the Crisis

Facilitator & Panel Members:

Moderator:

- Neil Gregory, IFC

Invited Interventions:

- Erik Berglöf, London School of Economics

- Paul Collier, Oxford University and International Growth Centre

- Nancy Lee, Center for Global Development

- Denis Medvedev, World Bank

- Dirk Willem te Velde, Overseas Development Institute

Key Insights:

Paul Collier:

- Uncertainty biggest issue. Real time data for developing countries are needed to properly analyse the impact of COVID – 19 and to foster transparency. Investors need to know in real time, how the companies are doing to increase trust, enable deal making and support for struggling companies.

- To enable loans, grants and equity, real time data are essential.

- DFIs have to ask themselves: “What would we have needed”. Now is the time to put in place the mechanisms and information platforms, that could have helped earlier.

- Chance to increase future resilience.

What can DFIs do?

- Common data/Organize data collection in systematic way – real time source of information on African firms -> learn from it yourself and present it to your shareholders to lobby for the firms.

- Vital to have a strong presence in every country (pref. city) of the DFIs -> need to coordinate better and cooperate among DFIs.

- Only very few instruments/Three instruments: Loans, equity and grants à need more money form shareholders (have data to back it up).

- DFIs have to operate in a field of radical uncertainty. They have to gather data as they go and anticipate bad outcomes. (Not avoiding risks, rather manage and prepare for them.)

Erik Berglöf:

- Aid capacity: PSD to build transformative capacity of a state. Fear now: Role of states is weakening, since states are running out of resources. How can we protect state capacity?

- Scarcity of organizational capital: Incentives for banks to take money out; banks need to maintain exposures.

- Shift from a liquidity to a solvency issue -> shift to a financial issue.

Nancy Lee:

- System of DFIs is inefficient. Are not allowed to take high risks but have to take high risks, especially at the moment.

- DFIs should: Stretch funds (loan guarantee rather than direct loans), enable operations off balance sheet to take risks.

- Create a Special Purpose Vehicle for high risk investments by DFIs.

- Governments and DFIs should work closely with Microfinance institutions and mobile payment providers to reach the Bottom of the Pyramid.

- Debt relief might work faster than negotiating new credits.

- Time to use private innovative business models (mobile payment service providers).

Denis Medvedev:

- Governments should think of financial support, tax relief and employment programs especially with regard to the low-income communities.

- Question the relevance of companies before supporting them: prioritize according to relevance for economy and its future development.

- Should be realistic: We will not solve all the problems of the last 30 years within the next months. Access to finance for low income communities will remain a huge obstacle.

Session 3:

Build Back Better: How Can Interventions Improve Private Sector Resilience, Sustainability and its Ability to Provide Good Jobs?

Facilitator & Panel Members:

Moderator:

- Alessandro Maffioli, IDB Invest

Invited Interventions:

- Caroline Ashley, Forum for the Future

- Stefan Dercon, Oxford University

- Rob Floyd, African Center for Economic Transformation (ACET)

- Kusi Hornberger, Dalberg

Stefan Dercon:

- Who to protect? Supporting SMEs guarantees jobs, big firms are more dynamic and might be better able to adapt to new economic circumstances.

- Do not support companies that should have died before the crisis!

- Do things that you would not regret even in other circumstances (investment in environmental protection/ clean energy/ sustainability)

- Data collection: Yes, but do not aggregate them globally (maybe aggregation on country level).

Caroline Ashley:

- Huge costs of transition -> some of costs now are what would have been in the future.

- Risk that crisis increases exploitation of human rights, poverty levels, inequality etc. DFIs need to work hard to just stay at the current level

- Leadership skills are needed both in DFIs but also in firms to deal with uncertainty.

- What to change: free education (reskilling), role of DFIs (special purpose vehicle), re-imagination of economic system, resilience back into supply chain.

Rob Floyd:

- DFIs need to help countries identify the projects which are have the most importance for the countries.

Kusi Hornberger:

- DFIs should take more risks both now and moving forward

- Uncertainty is the word of the hour

- Crisis has accelerated good and bad trends!

- KfW and Dalberg are already working on a SPV for Africa.

- The role of NABs in responding the coronavirus: examples from Africa and the UK

-

Date: 6 May 2020

Organised by: Impact Investing Institute

Facilitator & Panel Members:

Hosted by Sarah Gordon, chief executive at the Impact Investing Institute New accordion content

Panellists include:

- Sebastian Welisiejko, Chief Policy Officer at the Global Steering Group for Impact Investment

- Rebecca MacDonald, Investment Director at Big Society Capital (BSC)

- Dolika Banda, Board Member at CDC and until recently the CEO of African Risk Capacity Insurance Ltd

- Monique Mathys, Senior Advisor and Public Markets Lead at the Impact Management Project and previously with the South African NAB

Description:

As part of the Impact Investing Institute’s new knowledge exchange series, this webinar focuses on the role of impact investing National Advisory Boards (NABs) in setting up financial support facilities for social enterprises and charities affected by the coronavirus crisis. The webinar draws on experiences from the UK, Sub-Saharan Africa and elsewhere, presenting examples of effective interventions taken by NABs.

Key Insights:

The responses to the coronavirus roughly follow the three phases of emergency, recovery, and renewal, in which NABs can take on different roles.

Emergency phase:

- Share/Facilitate the sharing of information (approaches and learnings from different stakeholders).

- Focus on supporting existing portfolio companies to navigate through the crisis.

- Deploy opportunities for new funding (government guarantees etc.).

- Blended finance instruments were quickly set up in India, Finnland, Australia and South Africa. Government funds and guarantees are used to leverage the available amount of capital.

- Streamline processes to act faster. Downside of streamlined processes is the loss of flexibility in supporting a broad range of companies.

- In preparation of the recovery phase: companies will require growth capital to recover, start talking to financial sector now to sensitize and raise awareness for the need of adjusted evaluation mechanisms.

- Link pressing social issues to capital support measures: Outcome-based commissioning.

- Now is the time to talk to DFIs: Institutions such as the AfDB are actively supporting the economy and are willing to support where it is needed. Require a solid plan as a condition for support.

Recovery & renewal phases:

- Prepare evidence and further capture data, stories to showcase the potential of impact investing.

- Time to act is now: mainstream awareness among public, financial sector and policymakers that this crisis only amplifies existing pre-corona states of emergencies. The next crisis will hit even harder, if society does not move to new forms of economy.

- The time to shine for impact investing is now: crucial social issues need to be linked with financial instruments.

- Involve communities in designing post recovery economies.

- Be prepared for uncertainty. Government cash flows are unpredictable due to decreased tax revenues and already high debt levels in countries.

- Africa’s largest asset is its young population: If Africa can capitalise this, it will benefit in the long-term.

- Female entrepreneurs will be hit hard. It is necessary to put a gender lens on every investment.

- TechnoServe Connection: How women entrepreneurs in Mozambique are confronting COVID-19

-

Date: 5 May 2020

Organised by: Technoserve - business solutions to poverty

Facilitator: John Keightley, Vice president of Development and Communications at TechnoServe US

Panel Members:

- Sarah Bove, Deputy Programme Director Women in Business / Business Women Connect TechnoServe Mozambique and gender lead for TechnoServe Mozambique

Description:

TechnoServe offers a 5-month training programme to female entrepreneurs in Mozambique. During this programme the entrepreneurs learn about mobile banking, business accounting and business strategy. Sarah Bove offers insights into how the programme has adapted to the new circumstances and how the female entrepreneurs overcome the new challenges.

Key Insights:

Major challenges for female entrepreneurs are:

- A lack of formal employment for women which is why many become entrepreneurs by necessity.

- Mutual distrust between financial institutions and female entrepreneurs.

- Lack of time, as most women have to take care of their families and the household by themselves.

- Lack of support from family members and partners which leads to a lack of confidence.

How are these issues addressed?

- Counsellors spend much time in training sessions, in person and at distance. Psychological training starts before business training as confidence and psychological stability are key to a successful business.

- Teach the importance of savings: Divide between business and personal use. Ensure an emergency fund.

- Work with mobile network operators: help in facilitating money transfers through phone.

- Go into communities to get access to elders/community leaders to promote the programme. The community leaders then go on and invite female entrepreneurs.

- Save safely (working with banking agents to promote role of saving in an account and not in cash at home).

- Successful businesses can help women to increase their role within the family. Once family members see that they earn more money and contribute to the household financially husbands and other family members start supporting women in their household activities.

Covid-19 Changes & Response:

- Coaching and Counselling on phone. Work with urban and peri-urban women and therefore can communicate with them as 85% have WhatsApp.

- Reorganized programme depending on the operating sector: Focus on management; access to finance; how to diversify operations or change business model entirely; support on implementing health precautions and how to manage clients with Covid-19.

- Two weekly sessions on WhatsApp with clear structuring: Video of a counsellor giving an impulse and general introduction into the topic of the daily session; Pictures of best and worst practice; interactive questions; 1,5h duration; provide phone credit to clients to ensure they can participate.

- WhatsApp groups are subdivided into type of business to augment exchange within the same sector to help each other. Foster the sharing of information.During Covid-19 the duration of the programme might be longer but this cannot be foreseen at the moment.

- Of initial 60 percent of the business operations expected to close, only 25 percent really did close. Due to intense training and support most were able to diversify or change their business model entirely.

- Share all information of government and official sources; where to get hand sanitizers; advice on suppliers and logistic companies who do not overcharge at the moment.

- Nourishing Africa/ MyFarmbase: Building Resilience for Smallholder Famers Post Covid-19

-

Date: 30 April 2020

Organised by: Nourishing Africa, MyFarmbase

Facilitator: Oluwafemi Royal Aliu, AgriTech Consultant

Panel Members:

- Mark Edge, Director of Collaborations for developing countries at BAYER

- Debisi Araba, Former regional director at CGAIR’s International Center for Tropical Agriculture (CIAT)

- Angel Adelaja, SSA to Ogun State Government on Agriculture

- Rahmat Eyinfunjowo, Operations lead, Nourishing Africa

Description:

Organised by MyFarmbase and Nourishing Africa, experts discuss the Nigerian agricultural sector regarding its weaknesses and threats through Covid-19. They identify solutions on how these can be overcome, and which opportunities exist within the sector.

Key Insights:

Threats and opportunities of Covid-19:

- Large losses during the harvest due to insufficient storage facilities and slow transport of goods might get worse and should be prevented at all costs.

- Government must invest heavily into infrastructure (roads, electricity, internet) to better connect farmers to markets and reduce spoilage of food.

- All smallholder farmers should be connected with each other through cooperation and networks in order to ensure a good allocation of resources.

- Farmstack is a mobile app that helps farmers to access everything they need. It also helps them to identify opportunities.

- Radio and television are used to inform farmers as they lack access to internet. These channels have to be strengthened until access to internet is provided.

- In Nigeria, the agribusiness sector receives the full support of government during the crisis. Transport to and from farms is exempt from lockdown restrictions and local government officials work closely with security forces to ensure that the value chains in agriculture are not disrupted.

- Programmes to strengthen the rural infrastructure and agricultural hotspots are intensified. These programmes will serve the Nigerian agricultural sector after the crisis as well as the infrastructure, being provided and improved now, is essential for future growth. In the long term, Nigerian smallholder farmers might benefit from Covid-19 as it serves as a catalyzer for these much-needed investments.

Overall problems within the agricultural sector:

- Farmers are afraid to use seeds that are tailored to their needs and environmental conditions. Optimised seeds could increase the yields and augment resilience of crops.

- Farmers should not only receive seeds but also education on agricultural best practices. This education is not only the responsibility of the government but also of those firms providing the seeds.

- Value chains have to be strengthened. Farmers need access to information on prices and an online market place to receive fair value for their products.

SMEs and agribusiness:

- Overall investment into agribusiness has to be increased. Agribusinesses are SMEs as well and need funding to grow. The African Development Bank (AfDB) has tailored instruments in place to provide blended finance to agribusinesses.

- Financial requirements not only for seeds but for machinery as well. If harvests can be automized, spoilage of agricultural goods can be reduced drastically.

- SMEs are also present at other levels of the supply chain as distributors and customers. These SMEs should gain access to finance to support the growth of their company and fill in the gaps within the supply chain, that the government cannot fill.

- “Government has to provide the framework and the NGOs and the private sector have to fill out the gaps.”

- Strengthen crowd-funding opportunities for agribusiness SMEs: Many investments are too small to attract large investors but could be interesting for crowds of small investors.

- Tax incentives have to be put in place to attract investors who can fill the gaps, the government cannot access or only at high costs.

- Many young people are active in agribusiness but they lack ownership. They are often the ones with creative ideas but lack the resources to realise them. Therefore, ownership by young people should be strengthened through access to finance.

- AVPA: Global Responses to a Global Pandemic webinar series #3: Sharing African responses to COVID-19

-

Date: 28 April 2020

Organised by: African Venture Philanthropy Alliance (AVPA)

Facilitator: Dr. Frank Aswani: CEO of AVPA

Panel Members:

- Angela Oduor Lungati: Executive Director of Ushahidi, a non – profit technology company

- Andrew Waititu: CEO of Safe Hands Kenya, an initiative to distribute hygene products to Kenyans living in vulnerable circumstances

Description: Dr. Frank Aswani discusses with his two guests their approaches in tackling the Covid – 19 pandemic.

Key Insights:

Ushahidi:

Wants to democratise information by providing interactive online tools that can be used to exchange information during times of crisis. “Frena la curva” is one of many interactive maps on the webpage that shall help to coordinate the supply and demand of support during the Covid-19 crisis. Wants to give isolated communities a voice as they will be hit hardest and face the risk of being forgotten. Hosts Covid-19 platforms all over the world where every user can register and offer help or ask for support. Funds themselves through for-profit content and membership. Suspended most costs for platform users after Covid-19 emerged.

Safe Hands Kenya:

Coordinated effort of Kenyan enterprises to distribute hygene products to vulnerable parts of population. People living in slums cannot afford to stay home and social distancing is not an option due to crowded amenities and high population density. Dump sites often located close to slums, increasing the risk of the local population to get infected through disposed hazardous wealth from hospitals and other facilities treating Covid-19 patients. Operations are funded through grants of which over 80 percent come from outside of Kenya. Dispersed large amounts of soap, hand sanitizers and disinfectant to vulnerable communities in two slums in Kenya.

- How companies and land-based operators in Africa are responding to Covid-19

-

Date: 23 April 2020

Organised by: IDH, FMO, Mirova and Proparco

Facilitator:

- Nienke Stam, Head Landscapes Finance, IDH

Description: Different private and public sector acteurs discuss measures against COVID-19, its impact on supply chains and production and how business can prepare themselves and their communities.

Key Insights:

Session 1: Covid-19 Supply Chain Impact, and Business Continuity Planning - Anish Jain, Chief Treasury Officer (CTO) & Head of Corporate Communications and Marketing, Export Trading Group (ETG);

- Employee safety first and then manage supply chains. Conduct safety briefings,provide protection gear and upgrade medical supplies.

- Support to workforce: Newsletters are being sent around to create a sense of community and support staff working from home. A special focus in on the workforce that is still going to the plants.

- Logistics: work with every involveved party in the supply chain, including the government

Session 1: Covid-19 Supply Chain Impact, and Business Continuity Planning - Gary Rynhart, ILO Senior Specialist:

- Virus is causing disruption: to garment industry, mining, tourism, big infrastructure projects, oil, other industries.

- risk of exacerbating existing tensions and there has already been an increase in crime.

- Impact on enterprise: Conducting normal enterprise activity is at best highly challenging because the key ingredients – stability and predictability – are absent.To assess the risk profile of your enterprises and the level of vulnerability to COVID-19 in terms of its impact on your People, Processes, Profits and Partnerships (the “4Ps”) you can use the Business Continuity Plan tool by ILO.

- A new resource is under development with GIZ. A sustainable and resilient enterprise platform will be shared in coming days: SRE Platform (live next week): https://conflictdisaster.org/

- What can be done? Private sector response through vulnerability funds as in South Africa and Madagascar (GEM).

- ILO produced a guide which has been transposed into the legal situation around Covid-19 in a number of countries.

Session 2: Occupational Health & Safety during Covid-19 - Gretchen Blake, Chief People Officer at MTO Group.

- Including subcontractors in Covid response.

- Pre-lockdown response: Prohibit non-essential travel; Established a Covid-19 Task Team; Develope a Contingency Plan; Hygiene protocols; Scenario planning and actions to follow; HR Protocols related to impact of Covid-19. Stay responsive to changes.

- Planning a phased resumption of operations: A sudden start up is still not feasible.

- Screen employees before they return to work.

- Share resources with wider community.

- Local procurement is a good option.

- Planning is needed for transporting employees:

- Employees who do not comply with standard operating procedures in respect of Covid will be subject to a disciplinary process (misconduct). Same applies to employees of contractors.

Session 2: Occupational Health & Safety during Covid-19 - Teddy Deroy, Director at IBIS ESG Consulting.

- Company clinics in remote areas are crucial: Your farm / plantation / forest camp clinic or health centre is often the only health infrastructure locally.

- Increase capacity by collaborating with other health centres

- Review stock of PPE (masks, gloves etc) and ensure that strategic stocks are maintained at the local health centre.

- At least cotton fabric masks should be worn and these are being manufactured across Africa.

- Leaders of the organisation must lead by example. They must wear masks, socially distance and wear gloves.

- Recognise good behaviour: Endeavor not only to react punitively to bad behaviour but reward compliance.

Session 3: Communications and outreach to local communities about Covid-19 (panel discussion)

- Indirect access: Shared Covid-19 safety messages with influencers in communities through WhatsApp platforms and phone calls; Experimented with delivering Covid-19 safety messages through audio messages on phones.

- Lessons learned among direct access communities. We pushed messages through different platforms; we have seen most change through pathways that people are most familiar with, where we had prior practice of change. Audio messages are not that effective so far.

- Ensuring business continuity: Numbers of workers have to be reduced and this has a massive impact on the communities

- Risk of social unrest if mortality changes social dynamics: If, as in Europe, the victims of the Coronavirus are disproportionately elderly and male, this may have knock-on societal and cultural effects due to shifting land rights.

- Provision of knowledge or equipment alone will not change behaviour: Within a workplace setting, people may comply for fear of losing their job, but to be carried into personal life and communities, the information needs to be perceived as useful to the receiver in order to motivate behavioural change.

- Sahel Capital: Covid-19 Growing your business in a crisis

-

Date: 16 April 2020

Organised by: Sahel Capital

Panel members:

- Dr. Okey Nwuke: Coscharis Farm – An integrated rice business with a 2,500 ha rice farm, 40,000 MTPA rice mill, and silo warehousing.

- Mr. Vinod Vaswani: Polyfilm Packaging – Produces packaging material for FMCG and agricultural sector companies.

- Ms Saudat Salami: Easy Shop, Easy Cook – E-commerce company linking food producers with consumers.

Coscharis Farm:

- Integration is a major business model aspect to be able to weather the crisis.

- Cash and liquidity are king and require utmost management attention.

- Integrate and leverage new technology in the business to ensure business continuity after the crisis as the business world will be changed.

- It helps to have an up-to-date risk management framework with different scenarios in place.

Polyfilm Packaging:

- A good infrastructure is paying off such as good factory layout, hygiene regulations, etc.

- Good and honest communciation with customers is key to manage the crisis. Finding solutions together will help create loyalty beyond the crisis.

Easy Shop, Easy Cook:

- Competitive landscape is changing profoundly as more companies are getting into e-commerce.

- E-commerce and delivery become acceptable consumer behavior and are no longer associated with laziness (too lazy to go to market), which is further fuelling the e-commerce sector.

- E-commerce does not need to be explained any more to consumer – growth after crisis expected.

Link: Listen to the recording

- LatImpacto/IVPN: Global Responses to a Global Pandemic Webinar #2: Sharing Latin American Responses to Covid-19

-

Date: 15 April 2020

Organised by: Latimpacto and IVPN

Facilitator: Carolina Suarez, Latimpacto

Panel Members:

- Luiza Serpa, Instituto Phi

- Fernando Cortés, Fundacion Bolivar Davivienda and Corporate Social Responsibility, Grupo Bolivar

- Jana Vasileva, Iniciativa Ensamble

- Roberto Navas, Fundación Arturo y Enrica Sesana

- Luisa Mariana Pulido, Fundación Eugenio Mendoza

- Marcos Kisil, Institute for the Development of Social Investment (IDIS)

- Victoria Florez, IDB – Office of Outreach and Partnership

- Yuri Soares, IDB -LAB

Latin America at a glance

- 70.000 cases, fragile health system, young population with only 10% of population being older than 65.

- 99% of companies are MSMEs and these will be hit hardest therefore much support is needed.

- 53% of companies operate in informal sector. This sector is hard to reach and support and therefore might be critical.

Fundacion Bolivar Davivienda on the role of foundations

- Foundations of companies have special responsibility in supporting communities and encourage companies to be proactive (e. g. backing their operations). Foundations are the social arm of private sector firms and now have a higher importance than ever.

- Focus on supporting health infrastructure and improve allocation of ressources.

- Problem of corruption cannot be avoided. Due to emergency situation one has to risk losing aid to corrupt actors. Nevertheless one should avoid organisations and foundations known for corrupt practices.

This is how the speakers describe the general challenges by Covid-19

- Social distancing of high importance.

- In Venezuela, there are already existing threads to society like other diseases (Malaria, typhus etc.). Infrastructure problems (power outages) are getting worse simultaneously because of stressed public system.

- Politics in Brazil are a huge problem as no funding for health system is available.

- There is also a huge demand in Brazil for donations to fund food and basic necessities for poor people.

How the initiatives are responding to Covid-19

- Instituto Phi is a joint operation by three foundations in Brazil. They created the platform ‘Rio contra Corona’ to raise donations that are distributed in the

- Iniciativa Ensembla is an agglomeration of 30 foundations. They support transformation of convention centers to temporary health centers and lobby automotive companies to change production to ventilators. In addition, they support the communication between private and public hospitals to better allocate space and capacities.

- Colombia cuida Colombia connects the private and public sector with their online platform. These connections are crucial because humanitarian organisations have the reach to the vulnerable parts of population but lack the means, which can be provided by the private sector.

- The Inter-American Development Bank (IDB) provides immediate financial support for health infrastructure. They support the establishment of safety nets for vulnerable population and provided 5 billion US$ to support SMEs in partner and non-partner Latin American countries. IDB created a CoronaHUB to exchange information.

- The online platform Mercado Libre provides access to financing and redistributes funds to smaller NGOs.

- Fundación Eugenio Mendoza supports micro finance institutions (MFIs) and vulnerable population in general as they will behit hardest. They are currently creating a platform to link MFIs, microenterprises and informal workers to better allocate resources.

- Politics in Brazil are a huge problem as no funding for health system is available. This is why IDIS Brazil supports an emergency fund to pay health workers. They have already received monetary and non-monetary donations in value of US$ 1.5 billion.

- The IDBLab focuses on innovation for inclusion. They have created bidlab.org, a platform for start-ups tackling the Corona Virus. Start-ups are reviewed and then uploaded on an interactive map. Potential supporters and investors can review the start-ups. Start-ups from Colombia managed to find a way to produce 90 ventilators per week and another start-up focused on creating a market platform connecting informal workers with MSMEs searching for workers. Plan to launch a life-vest platform for start-ups.

- Covid-19: Building resilient and inclusive agribusiness models in Africa

-

Date: 14 April 2020

Organised by: Sahel Consulting, iBAN and Nourishing Africa

Facilitator: Andrew Kaiser-Tedesco, Director, Africa and Impact Investment, iBAN

Panel members:

- Henk Van Duijn, Programme Director, 2SCALE

- Emiliano Mroue, CEO, The WARC Group

- Michelin Ntiru, Advisor-Agribusiness, Africa and Latin America

- Deji Adebusoye, Vice President, Sahel Capital Agribusiness Managers

Webinar discussion:

Henk Van Duijn, Program Director, 2SCALE

Key focus: Report on impacts of the pandemic on agribusinesses that 2SCALE is working with and responses from 2SCALE to support affected businesses

- Consideration for the planting season: “If crisis extends, we will have a food crisis in West Africa which could be devastating.”

- Free resources and surplus food which is perishable need to be allocated efficiently through communication between MSMEs

- Main problems that arise are a decline in sales and problems on logistics because of the closed borders. Moreover, the general consumer profile might unpredictably change through crisis.

- Henk suggested three ways to support entrepreneurs in this critical time: 1.Brokering with financial institutions (loans), 2. Provide more working capital. 3. Raise awareness on how companies can continue their operations while taking the necessary health and safety precautions

- He also stressed the importance of staying liquid

Emiliano Mroue, CEO, The WARC Group

Key Focus: Insights on building resilience from personal experience during the Ebola crisis.

- Emiliano sees many similarities with the quarantines, lockdowns and border closures happening with Covid-19 and his experiences during the Ebola crisis.

- He describes different stages on how to cope with the crisis and points out the emotional pressure on the entrepreneur

- Before creating new business plans, he stresses the fact to economically survive as a business: “We need to become clear minded and keep the team focused on how we can survive”, “We use this time to identify possibilities. But before we thrive, we need to survive”

- It is important to manage the cashflow: For instance, Emiliano managed to negotiate a one-year rent holiday

- Emiliano advised agribusinesses to remain inclusive but prioritize survival in this period

- There is the possibility to grow and expand through a crisis: “WARC survived the Ebola crisis and expanded thereafter through a much stronger business model with two income revenue streams.” This was in direct response to the Ebola crisis, deciding to open a new arm of the business that it not entirely dependent on a physical product.

Michelin Ntiru, Advisor-Agribusiness, African and Latin America

Key Focus: Human Resources/Leadership and Leveraging Support Systems

- “Lead with empathy, be as compassionate as possible but also be nimble and flexible to issues as they arise”.

- “80% of our food in Africa comes from smallholder farmers so it is important that we check in on their health, safety and food security.” “Safety and Health is the top priority for your team.”

- Instead of cutting off employees, Michelin Ntiru recommended cutting off a percentage of the upper salaries paid within a company. If reducing the number of employees is necessary: “Make sure that you are in contact with a legal compliance and get yourself a lawyer.”

- It is important so share knowledge with other entrepreneurs and connect: “This is not the time to be alone. We are in the age of an abundance of information. Get into a cluster with similar businesses to leverage available support and weather this storm together”.

- “Now is the time for entrepreneurs to make sure they have a risk system structure. Now it is the time to practice them.”

- “The answer will not necessarily come from the outside because every company situation is unique. So now it is the time to form an action plan.”

Deji Adebusoye, Vice President, Sahel Capital Agribusiness Managers

Main point: Need for an action plan/ risk and scenario planning

- Entrepreneurs need to ask themselves the tough questions how resilient is their supply chain going to be? There is a need to assess the strengths and weaknesses of companies depending on their different distribution channels - B2B/B2C/Export oriented etc. have different demands and must be regarded and consulted differently.

- Supply chain ease: how can the company manage stock, supplies and inventories? Supply chains are impacted by transport and solutions must be developed

- Cash is king: look how you can maintain liquidity within the company and see what options exist.

- Agri-food businesses need to consider how they can change their production operations and create new products or modify existing ones. The demand for agri-food products is still there but needs to be addressed differently.

- Entrepreneurs need to ask important questions such as, ‘do you really need funds to keep your employees or you need it for production and cash generating operations’? This determines the type loan and financing you should look for

- There is a need for businesses to have a ‘technical assistance’ vehicle to support on engaging and managing employee, HR-resources, and providing support on how risks be approached.

- “The appetite for investors is not gone, it is still there. It is not as strong as it used to be, but it is still there.”

- “Good investors will check out your previous performance as a company. Be clear what your plan is for Covid-1, because if you are not clear the investor also isn’t.”

- For entrepreneurs who do not have an investor working with them:

- “It is a good time to get the ‘house’ in order.” Businesses should take this time to work on how they can survive this period and adapt their business models to withstand future shocks, either from the supply chain perspective or from the customer perspective.

Some final words by the Moderator, Andrew Kaiser-Tedesco

This could be a long haul, so think aggressively about your management and cash structure. It is either you think you can adapt to this crisis or think of new roles and opportunities that have or will present themselves at this time. Entrepreneurs need to stay strong, not just busy. Set up your team in such a way that they can support you and revive their goals and yours during this time.

- African Management Institute: Covid-19: Business Survival Bootcamp

-

Organised by: The African Management Institute (AMI)

Facilitator & Speaker: Andrea Warriner, African Management Institute (AMI)

Challenges through Covid-19 arise for all companies, no matter their size. To help African businesses continue to thrive, AMI is offering a free webinar series, with a ‘Covid-19 Business Survival Toolkit’ betewen 26 March and 30 April. Below are main recommendations from one of the webinars.

Key insights:

Scenario planning:

- Plan for best case, worst case and middle case.

- Special attention to: Team, Facilities and Cashflow

- Team: How is your team affected? How is your ability to get to work affected? Are some members more affected than others? What type of support might your team need?

- Facilities: How might your key facilities be affected (Building, store, equipment)

- Cashflow: How is revenue affected? How significant are these effects?

Organisational risk assessment:

- Customer/Revenue - magnitude

- Suppliers/Costs – can they be deffered, reduced, renegotiated?

- Infrastructure – How are the risks for your supply chain? How are is your distribution affected?

- Access to finance – Do you have access to other finance sources?

Adress risks:

- Access all government resources. AMI publishes all measures on their websites with regard to their main locations in Ruanda, Kenia and South Africa Reduce salaries, if possible. If no other way, send workers into furlough.

- Ask large companies, who supply your business, to make upfront payments or provide credits. These companies are often better able to stay liquid.

Forecast cashflow:

- Plan cash flow for all scenarios for the next 4-6 months. A tool is provided in the membership section of the website.

- Hard choices might have to be made in order to remain liquid until the end of the period.

- Hystra: Resilience for inclusive businesses: Pivoting business models in times of Coronavirus

-

Date: 9 April 2020

Organised by: Hystra

Facilitator: Simon Brossard, Hystra

Panel members:

- Philip Wilson, Founder of Ecofiltro: water filters, Guatemala

- Mike Sherry, Director of Mwezi: cook stoves, off-grid solar systems and appliances, Kenya;

- Laura Pargade, Marketing Director of Moon: off grid solar, Senegal, France;

- Geeta Kanupillai, GM Marketing and Communication at Sarvajal: drinking water ATMs, India.

In a matter of days, Covid-19 forced inclusive business practitioners to come up and test new solutions. They had to adopt business operations and pivot their business models in order to protect staff and clients, ensure business continuity and provide active solutions to tackle the crisis.

Kenyan cookstove and solar company Mwezi came up with a business model adaption framework “4 Rs” that allows them to follow a more structured decision-making process during this crisis. The four Rs stand for: React, Reimagine, Reshape, and Rebound. The practitioners share their experience along the framework.

REACT: How to quickly react, especially to protect staff and clients

- Understand what is going on and how Covid-19 affects your company and your customers. If possible, use your research facilities to get the data needed.

- Permission to operate: Find out if you can operate and under what conditions. It is necessary to get official permission.

- Educate your staff on health protection measures as well as on symptoms of the Coronavirus.

- Install health protection measures (hand washing, hand sanitizers, social distancing through markers on the ground etc.) at all your sites (factory, distribution, sales points).

- If possible, support your employees to be able to stay at home (e.g. one-week food supplies delivered to workers).

- Allow employees to do home office if possible and limit the number of people at production sites to a minimum (e.g. no open factories).

- Use your distribution and sales agents as well as your communication tools to educate and inform your customers (e.g. sms broadcast, digital content on apps, websites, platforms, posters at distribution/sales points).

REIMAGINE: How to re-imagine models to continue serving consumers and, when possible, actively contribute to solving the crisis

- Ensure your service is safe to be used by your customers (e.g. Sarvajal worked on new firmware to make technology of ATMs touchless).

- Use your current client data to make upsells or to target selected areas with a high density of customers.

- Use e-commerce; e.g. since traditional shops closed, Ecofiltro found a new distribution partner who is now delivering the water filters by motorbike.

- Last mile distribution models: The mobility of sales agents is not safe in the current situation. Find ways to densify distribution of crucial products and services on a village level rather than going from one household to another; e.g. Moon leverages local relays.

- Repurpose your technology; e.g. Mwezi is using their technology to match farmers producing surpluses with customers struggling to get food.

- Repurpose your team, e.g. Sarvajal had their field staff that (drivers, operators etc.) support local communities and administrations to educate people, to sanitise locations as well as to provide for people in quarantine.

RESHAPE: How to implement, “test and learn” to reshape models

- Do not be too ambitious; delivery time and geographical reach might not be the same, especially in the beginning of the restructuring.

- It might make sense to employ more people to react on changes in your operations.

- Allow yourself to change the plan as new information arise.

- Communicate efficiently and quickly. Furthermore, involve people in the field in your communication decisions.

- Access to reliable, cross-checked information (on health and education) is valued by your customers. Free information is an added value.

REBOUND: How to prepare for a post crisis rebound?

- Check if changes are also valuable and beneficial in the future; Ecofiltro wants to stay an e-commerce company, since it enables them to directly communicate with customers.

- Learn about expectations and needs of customers.

- Find new ways to communicate with customers.

General advice:

- Demand for beneficial products has increase in period of resilience, therefore retain and use existing clients (upselling + building relationships through additional services).

- Find ways to reach and cater new clients safely.

- Stay authentic and maintain your reputation as an impact company by not taking advantage of crisis but giving back to the community!

- Sun Business Network: Covid-19 & SMEs – Challenges and Mitigation

-

Date: 8 April 2020

Organised by: SUN Business Network

Facilitator: Uduak Ibeka, SUN Business Network

Panel Members:

- Pelumi Salas – Cato Foods

- Yemisi Obe - Prothrive Aslute Heights

- Prof. Olugbenga Ogunmoyela, CAFSANI

- Ndidi Nwuneli - Sahel Consulting

- Lawrence Haddad - GAIN Executive Director

- Adenike Adyemi - FATE Foundation Executive Director

- Victoria Madedor - BOI Investment, Head of Agribusiness

BOI is extending operations to provide working capital for SMEs in Agribusiness --> Fund MFIs that distribute the funds to SMEs High burden often collateral. Therefore: Use Collateral Registry System to register moveable assets as collateral. Certificate will enable you to provide security to lender. Infracredit bank issues collateral guarantee in exchange for fee. BOI has an online platform to foster exchange between SMEs BOI helps MFIs to connect SMEs with logistics. Stresses the importance of good corporate governance. When approaching BOI and being able to clearly outline business model, market and especially finances and legal compliance, every SME will receive financing. Who comes prepared receives funding.

Overall business activity

Agrifood sector needs to be more vocal. Address policymakers directly as the risk of people starving might be higher during Covid-19 than dying from Covid-19 itself. Importance of working together and forgetting competition at the moment. Nourishing Africa is an online platform to connect agribusinesses. Strengthen e-commerce and other business models. Strengthen staplefoods wherever possible as these are less affected by crisis. Agribusiness of SMEs is linked throughout economy therefore highest priority. A survey of 1.000 MSMEs on Covid-19 revealed that 50% were sure their businesses would not survive the crisis, 45% had serious doubts, the majority is not able to digitise operations, many cut costs at their workers, most of them have only cash for 4 weeks. SMEs should also look at their opportunities now (assets for sale, pursue other business models, build up networks that can be useful in the future). Provide a business continuity plan to finance providers and suppliers. Keep mental health in focus. Not only of workers but also of entrepreneur. Clear communication and leadership are asked more than ever. If possible, renegotiate wages, as conform with legal framework. Companies should build a network to coordinate demand and supply: Maybe one company has produce in abundance that another one desperately needs. Cooperate when digitizing: Associate with other SMEs and order a template for an online platform together at a web-developing agency. The template can then be used by everyone.Be investment ready as soon as possible! Upon approaching funds and investors who will set up Covid-19 Funds keep in mind 6 key investment criteria:

Strong governance (Have a Board of Directors to demonstrate clear competencies. Strong financial control (filed tax declarations, know your income situation, cash flow, equity…). Fulfill legal requirements. Have an own cash management system in place. (Electronic tools to track bills etc. might be expensive but not having them will be more expensive in the end. They can make the difference between an investor being ready to invest 10.000 or 500.000 USD Demonstrate ethical behaviour. Have a clear company identity.Finance:

Assess credit lines: Is addiditonal liquidity possible? Negotiate lower terms with banks and other lending institution. Look at the impact of currency devaluation and possible counter measures. Do scenario planning; 3-5 months of the best case and the worst case scenario for cash flow management Stop all variable costs if possible and reduce all fix costs where possible.- Access to market is restrained. No sales due to lockdown and resulting cash flow crisis.

- Access to credit is restrained : Bank of Nigeria reduced interest rates, local banks didn’t.

- Commuting is not possible under lockdown (check if accommodation of workers within production facility is feasable).

- Reduce pay for workers in April and May but compensate in the future.

- Deprectiation of currency. Tools and machines often paid in Dollar or Euro because they are purchased abroad. Falling currency creates big problems and increases financial burden.

- 70% of consumed food served through informal businesses.

- Unregulated companies could exploit shortages in food production and sell uncontrolled, unsafe food.

- Fear that in the end more people could be threatened by foodbourne illnesses than by Covid-19.

- Agrifood businesses shall ensure high standards despite crisis as costs of a recall or liabilitiy issues would be worse.

- Government should support businesses in packaging food in order to prevent losses and rotten food being sold.

Description:

The SUN Business Network invited managers from SMEs and from institutions that support SMEs to exchange experiences, share best practices and provide an overview of the situation during the Covid-19 crisis.

Key Insights:

Covid-19 does not only impact sales volume but also has negative effects on supply chain security and workforce.

SMEs have to prepare for a crisis by cutting costs, seeking support and networking with other SMEs. Many institutions offer help and funding. In order to be eligible for financial support, SMEs should prepare their accounting material and provide clear business plans for the upcoming months.

Input by SMEs and their experience:

Health education is important but also health provision for the customers. Workers can spread illnesses to all produced food and act as multiplier. Train workers on health issues (wash hands, sanitizer, importance of hygiene). Access to raw materials is restricted due to lack of transport. Transport in many regions not demed essential and therefore banned under the lockdown. Distributors have to drive to farms themselves to pick up produce, which makes it very expensive. - Covid-19 - What on-site measures can agricultural and forestry companies and sustainable landscapes operators take?

-

Date: 2 April 2020

Facilitator:

- Nienke Stam, head Landscape Finance team Senior Program Manager Liberia IDH – The Sustainable Trade Initiative

Key Insights:Session 1: World Health Organization (WHO) - Special Envoy David Nabarro

- Look after your workforce: Companies should be focusing on their workforce right now. They will need food and support and should feel supported. We are seeing in poorer geographies that some people are suffering very severely.

- Look after your supply chains: Ensure that your supply chains are robust. This situation may last for some time. Talk to your bankers and ensure that you have access to credit in order to be able to weather economic challenges.

- Work closely with your government.

- How can big companies play a role, how about SMEs? Businesses need to maintain customer loyalty, rely on markets continuing and have a lot of trust among customers and communities.

- The food sector has to be protected especially given the logistical challenges on the supply side and the difficulties faced by poor people whose income is reduced.

Session 2: Food and Agricultural Organization (FAO) - Maximo Torero Cullen - Chief Economist, on coronavirus and food supply chain under strain, ‘what to do?’Main supply shocks:

- Intermediate outputs like fertilizers are being affected.

- Labor intensity of production, which will affect the high value commodities.

- Macroeconomic issues: energy and exchange rate. Devaluation of exchange rates will create behaviors of exporting companies.

- Trade policies: showing that the logistic part is being resolved.

- Demand is being affected by the economic effects and will continue to be affected in future as a recession is coming.

- We will see less production because of lack of labor. Some countries are destroying produce.

- Developing countries/Africa: reduction in labour force, affecting labour intensive forms of production (agriculture).

- Transport restrictions and quarantine measures likely to impede farmers’ access to input and output markets, curbing productive capacities and denying a point of sale for produce.

- Food demand in poorer countries more income elastic, and loss of income-earning opportunities could cause consumption to contract.

- Expect shift in purchasing modalities: lower restaurant traffic, increased e-commerce deliveries (as evidenced in China), and rise in consumption at home.

What to do?

- Africa: We need to supply African countries with as much testing as possible.

- How to support: Orientating ourselves around crop calendars and looking into changing harvest or planting times, so that this can happen before people go on lockdown, this may help.

- Small farmers: We need to find ways to help farmers through safety nets. We can reduce the intensity of mobility by putting in place networks of collection centres. This infrastructure would be a good investment of aid money at the moment.

- How to ensure demand: Where there is infrastructure, we can use e-commerce.

- Trade: We cannot allow trade restrictions or export barriers, because this will artificially create a food crisis. There is a huge opportunity to empower interregional trade.

Session 3: Matt Karinen, David Rothschild and Viganeswaran Ponnudurai; Sharing experiences from Liberia during the Ebola crisis. The former team of the Sinoe and Grand Kru palm oil plantation company located in Liberia.

In retrospect, the four key elements were:

- Early recognition & planning

- Communication

- On the ground actions

- Cooperation

Early recognition and planning: What you can do now is look ahead, organise, think and act for the next stages of Covid. Look now beyond the next step, be thinking about the two next phases already.

Crisis management team: We had a crisis team talking daily: the two directors, two or three on-site leaders.Secured supply chain: We stocked up on fuel, medicine and food to take care of operations and employees’ wellbeing.Weekly plan reassessment: Be ready to change quickly.

Visible crisis management: We had to educate our workers and reach out to communities very actively and frequently.Communication via musters, daily: Maintain communication and revise as you learn more.Information sharing: We shared materials and best practices with the other companies – very useful.Logistical support: A coordinated effort is needed from the community.

Educate and support communities and workers → Use best practice materials, eg. WHO, CDC).It is extremely important to verify the health of people coming into a site if they're coming from the outside and to maintain constant checks for people that are on the inside.

Session 4: Business operators on the ground share their Covid-19 measuresFirst Speaker: Tatiana Pachon: Chief Country Officer, Forest First Colombia which is a large sustainable forestry company founded in 2010.

- Limiting rotation: People who were out on rotations in other parts of the country were asked not to return. We had to redesign our operations so that they could do other activities and not have contact with people in our plantations.

- Communication: A lot of pressure has been put on our communication, literally bandwidth so that people can be in touch.

- Cut down numbers of staff per shift to absolute minimum.

- Communication: Critical because people are not well informed about what is happening nationally.

- Incentives: A mixture of financial incentives and potential leave that could be taken at a later stage has been offered so that people who have not been able to take leave due to the rotation decisions can compensate that time.

What we've learned: - anticipate what your operational procedures can be - keep a flexible mindset because this is an ongoing change - communication: providing practical information on what to do - regular meetings with our management team and team leaders - keeping in touch with what's going on in the field and taking feedback into decisions.

Second speaker 2: Kate Mathias: Compliance Director, Miro Forestry & Timber Products Miro Forestry is a sustainable forestry operator active in Ghana and Sierra Leone

- Prevention: Soap and chlorinated water is provided, and every person must wash hands before boarding any transportation.

- Travel ban: on non-essential travel outside of the operational areas and reduced meetings of communities

- Published information: produced a public document for our workers and for the communities around details what happens now when we start to suspend or close operations and impacts on salaries and leave.

- Protection of older and vulnerable workers: These groups have been advised not to come to work

- ANDE Webinar: SGB Covid response measures

-

Date: 30 March 2020

Organised by: Aspen Network of Development Entrepreneurs (ANDE)

Facilitator: Jenny Everett, Managing Director, Aspen Network of Development Entrepreneurs (ANDE)

Panel members:

- Juan Carlos Thomas S., Global Entrepreneurship Director, TechnoServe

- Srinivas Ramanujam, Practice Lead-Agribusiness & COO, Villgro

- Robert Webster, Chief Operating Officer, SEAF

Description:

Jenny Everett from ANDE discusses response measures for small and growing businesses (SGB) with fund-managers and SGB supporters.

Key Insights:

- Scenario planning and cash flow planning are of highest importance.

- Approach business partners proactively and offer solutions to reduce costs and obtain liquidity.

- Assess changes to business model (online business, deliveries, remote services…).

- Make use of time and tackle tasks, that are neglected during ordinary business times. Update/redesign Website, improve product, implement new software, conduct research and consult customers for feedback and possible improvements of their experiences.

1. Focus on survival, conversation with donors on support measures.

What to do:

- Assess financial status quo

- Improve survivability by cutting costs, restructuring business model, evaluating and conducting new business models (restaurants – delivery)

- Digitalise operations where possible

- Fund managers should provide emotional support to cope with uncertainty and provide exchange in the community of SGBs

2. Scenario planning and use of time. Optimistic/realistic scenario 3 months without sales, pessimistic scenario of at least 6 months. Prepares businesses for 3-4 months.

What to do:

- Cut/ defer costs (interest payments/rents/salaries...)

- Downstream approach: The higher burden should be with the managing staff, normal employees shall not experience drastic cuts.

What could be done instead of business activity:

- Re-evaluate business model, contact suppliers, customers and other business partners to readjust business model.

- Use time to optimise websites, management tools, usual workflow. Topics that are neglected during normal business activity.

- Re-negotiate rents temporarily and preserve cash to start up business once crisis abates.

3. SGBs must be proactive. Businesses shall approach banks, investors and landlords actively and have plans ready on how to cope with the crisis and what they need.

What to do:

- Reduce costs, delay capital exposure, negotiate with banks and suppliers to defer payments. Bring a plan and demonstrate active crisis management.

- Discuss rent reductions with landlords and have a plan. Landlords are often willing to support but want a plan from tenants

- Have liquidity on hand to restart operations (100k-500k).

- Contact other companies from your network to exchange ideas, come up with solutions, share synergies and provide emotional support.

- Weak parts of society will be hit hardest, especially groups that are already struggling like minorities and elderly.

- Hurdles for women to start businesses will probably increase. GLI-Funds must become active and support female entrepreneurs more than ever.

The webinars were conducted by

- The African Management Institute (AMI)

- American University of Cairo Gerhart Center

- ANDE

- AVPA

- GSG

- Hystra

- IDH - The Sustainable Trade Initiative

- IFC - International Finance Corporation

- Impact Investing Institute

- LatImpacto/IVPN

- MyFarmbase

- Nourishing Africa

- Sahel Capital

- Sahel Consulting

- SUN Business Network

- Technoserve - business solutions to poverty