Talking #InclusiveBiz No. 3: Impacting the growth trajectory of women founders through innovative initiatives, such as Global Scale Up X

MIT D-Lab works with people around the world to develop collaborative approaches and practical solutions to global poverty challenges. A core initiative is the D-Lab Scale-Ups Fellowship Program.

In this third episode of the iBAN podcast, Jona Repishti and Amanda Epting, Managers at MIT D-Lab, provide in-depth insights into their work on solving crucial global gender financing challenges and incorporating inclusive innovation processes into the work of practitioners. Why is the gender financing gap so persistent? What experiences do women from around the globe share when it comes to seeking funding for their businesses? How can we make the case for inclusive business to investors successfully? Why do shared beliefs matter more than just funding when selecting investors? And why are innovative storytelling approaches like the one of Global Scale Up X Instagram channel recently launched by MIT D-Lab and iBAN important in helping smooth the entrepreneurial journeys of female entrepreneurs?

Key insights:

- The gender financing gap still is one of the most persistent problems in entrepreneurship today. Women entrepreneurs, particularly the ones in emerging markets, are systematically overlooked and underfunded - among others due to unconscious bias by investors, but also due to internal barriers female entrepreneurs face.

- In talking to about 50 female founders from 14 different countries that have a track record of raising from USD 10,000 to 15 million, two core shared experience emerged across the different geographies: 1) Women access networks in different ways. It is hence incredibly crucial for women entrepreneurs to build their network wisely, to lean into their network, and to invest in their network of customers, peers, mentors, and investors. 2) Financing matters, but finding the right kind of financing is more important. Therefore, it matters for female founders to set their own rules in terms of what kind of investors are a good fit for their business, because ideally the investment is a start of a long-term, meaningful, and growth-focused relationship.

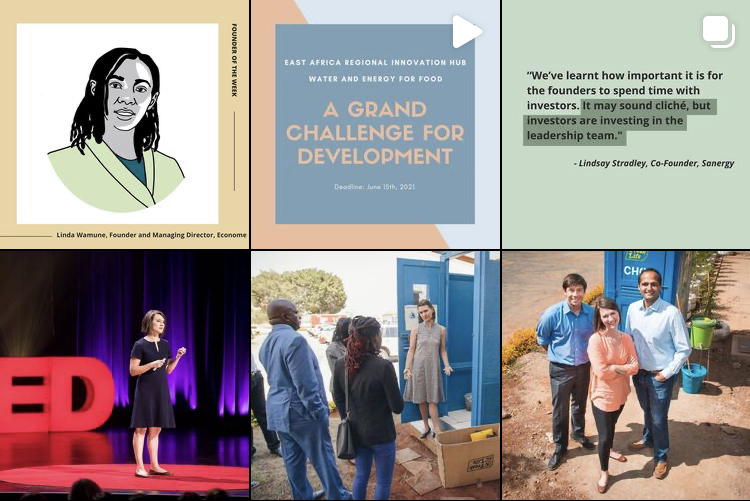

- Connecting the founders that the work of MIT D-Lab is centered around with founders in emerging markets that are focused on inclusive business working for the base of the pyramid is a win-win situation. This is why MIT D-Lab and iBAN recently founded Global Scale Up X – a new Instagram community for female entrepreneurs to connect, be empowered, and scale up.

- Innovative storytelling approaches like the one of Global Scale Up X matter because they help bring to the forefront the reality of challenges women founders face and how this can impact their growth trajectory. Read more about this crucial aspect in this recent blog post about the channel. Beyond sharing authentic insights and the inspiring vulnerability of shared experiences, the initiative provides orientation and inspiration to other women entrepreneurs to help them find the right type of financing to scale their businesses in a sustainable way.

- Ultimately, finding the right kind of funding comes down to intentionally seeking those investors that share the beliefs of the founders – those that believe in the same impact metrics and are committed to supporting women founders in their entrepreneurial journey for the long haul. Those investors will then align expectations every step of the way. Clearly defining those beliefs as an entrepreneur before even approaching investors is therefore very important.

- We are at an exciting moment when it comes to solving gender financing challenges. There are many initiatives that aim to propel and support female entrepreneurship and diverse and inclusive entrepreneurship. A selection of those opportunities is being shared on the Global Scale Up X channel regularly.

Join Global Scale Up X here.

Learn more about the topic in this report by IFC.