Beyond Chocolate

Much of the cocoa in your chocolate is grown in rural Ghana. While you may use your debit card to buy sweets, cash is the primary payment method for Ghana’s cocoa farmers. It’s used in more than 90 percent of everyday transactions with farmers. The same is true for many other agribusiness supply chains.

Those cash payments have a high cost for farmers and companies. Cash is slow and risky to deliver. This makes the delivery of cocoa expensive, costing more than USD 20 million – or 20 percent of all cocoa companies’ revenues every year.

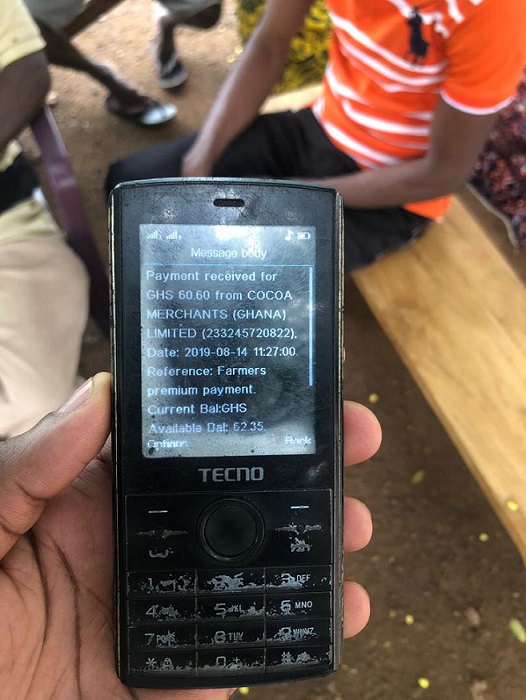

Cash payments also keep farmers from establishing a digital footprint that they could use to access digital credit, savings, and other services, both financial and beyond, that are readily available through their mobile phones.

In contrast, digital transactions, done responsibly, promise great benefits for all players in agribusiness supply chains. They offer farmers an important tool to lift themselves out of poverty. Cocoa companies profit from greater efficiency, transparency, and security, as well as the opportunity to strengthen business relationships between farmers and the purchasing clerks who are paying for cocoa beans in the community. Access to digital accounts and transactions can also allow more women to control their finances and participate in the economy.

Since 2018, several pioneer companies in Ghana’s cocoa sector have made a shift toward responsible digital payments and seen the benefits. In times of social distancing, digital payments have allowed their supply chains to continue functioning.

But these benefits aren’t unique to Ghana, or the cocoa industry. Other agribusinesses, in other regions, can reap similar returns by investing in the building blocks that form the foundation of a successful transition to digital payments.

Know your farmers

Every community is different, and so is each farmer. To gain the benefits of responsible digital payments, companies need to get to know their farmers. Do they have mobile network connectivity? How easy is it to access mobile money agents? Are farmers already using digital payments, or aware of existing services they can access? To answer these questions, a Ghanaian cocoa company has been using a survey (available here) to help them effectively design, raise awareness and start their digitization initiative.

The survey showed that 25 percent of farmers queried found mobile money easier to use and more customer-friendly than banks. In response, the company prioritized e-wallets for payments to farmers, rather than bank cards. The company also decided to absorb digital payment fees for mobile money transactions in one pilot program, because results from the survey indicated that it would encourage farmers to make the switch to digital payments.

Enable farmers to spend funds and access services digitally

Ghanaian cocoa businesses and cooperatives surveyed 338 cocoa farmers (102 female and 236 male) in April 2019 to gain in-depth knowledge of their spending habits: How do they spend money? What main services and products do they need to buy? What specific shops do they regularly visit in their community? Today, companies are able to share this knowledge with mobile network operators, who build the ecosystem of responsible digitization by encouraging shops and businesses frequented by cocoa farmers to accept digital payments. 52 merchant points were digitized in two cocoa growing districts as result of this survey, which revealed that farmers mainly spent money on farming inputs, education, payments for workers and food.

Champion the value of digital payments to staff and farmers

For digital payments to be widely accepted, staff from cocoa companies and farmers need to understand their value. Faced with Covid restrictions and the difficulty of physical access to remote communities, one Ghanaian cocoa company used open-source tools to drive the adoption of digital payments. The company employed both phone messages and community public address systems, in the form of megaphones placed in high traffic areas, which reached 3,703 farmers in 107 communities. The megaphones broadcast personal messages, full of practical information, such as this one:

“Greetings, farmers. My name is Maame Esi and I am a cocoa farmer like you. As a farmer, going to the bank can be a hassle. For my farm business, I often rely on digital finance because it's safe, convenient and less costly than traveling to a bank branch. It gives me access to monitor my account wherever I use my mobile phone. Plus, with digital financing, I can deposit and withdraw cash from any mobile money agent. Because it saves me time and money, my business is growing faster.”

With these building blocks, companies and farmers in Ghana have launched and scaled successful, responsible digital payments initiatives in the cocoa sector. The public sector recognizes their value and is spearheading the roll out of a Cocoa Management System (CMS), a digital database of all cocoa farmers in the country, to support further digitization efforts, including a payment platform.

These initiatives put Ghana on track to become a digital leader in Africa. But our hope is that this is just the beginning. We believe that other countries and agribusiness supply chains can learn from Ghana’s example, to accelerate their own efforts to shift to responsible digital payments and realize the benefits in their own sectors.