Editor's Choice, March 2014: What matters most to start-up enterprises around the globe?

What do 1000 entrepreneurs think matters most to the growth and success of their companies? Interviews with over 1000 start-up entrepreneurs provided the findings in this month’s Editor’s Choice, which focuses on how external factors, or the ‘ecosystem’, catalyse high-growth business.

The title is a mouthful, the report is long, but the content is rich. Entrepreneurial Ecosystems Around the Globe and Early-Stage Company Growth Dynamics is brimming with insights from entrepreneurs and implications for policy-makers.

It does not focus on the internal dynamics of early stage business - leadership, business models, or marketing – but on the external context, the ‘entrepreneurial ecosystem’ (see notes below for definition). It adds significantly to current debates on ecosystems by drawing on views of entrepreneurs, unpacking details of what matters to them, and looking at how companies and government create a supportive or inhibiting ecosystem for early stage business growth. It does not mention the phrase inclusive business, and indeed the majority of enterprises surveyed are neither in the South nor particularly inclusive. But the findings are highly relevant to anyone seeking to promote growth of inclusive business start-ups.

Across countries, three factors emerge as most critical to early stage enterprise growth:

- Accessible markets and revenue-paying customers: access to customers whether large companies, small companies, or government

- Human capital / workforce: access to management and technical talent, entrepreneurial experience, outsourcing, and immigrant workforce

- Funding and finance: from friends and family, angel investors, private equity, venture capital, and access to debt.

These are identified by survey respondents as the top three of eight ‘pillars’ of the ecosystem. It is interesting that ‘government and regulatory framework’ does not appear in the top three. The other pillars include support systems/mentors, education and training, cultural support and universities as mentors.

Across the board, the current strength of these pillars is scored highest in California’s Silicon Valley/Bay area, with the lowest score being in Asia, South/Central America or Africa/Middle East (the former scores 86% across all pillars, while the three southern regions score 41-45%). For those countries with sufficient sample size, country comparisons are made, with India receiving the lowest country score on 5 of the 8 pillars. That developing countries or regions score lower overall is probably no surprise. But it is interesting to see where regional differences are most apparent: difference in availability of managerial talent is more marked than for technical talent. Availability of venture capital is more uneven across regions than that of friends and family finance. Mentors are available across all regions, but not professional business support services. Access to telecommunications and infrastructure is more readily available across the regions than tax incentives and business-friendly regulations. Success stories are available in all regions, but tolerance of risk and failure varies dramatically, from 96% in Silicon valley to 22% in Central/South America.

This is not to say that all the developing regions must emulate the Silicon Valley model, but it is useful to see which areas of the ecosystem in the global South are weakest compared to that model.

The report explores who influences the ecosystem and how. Not surprisingly the role of governments and regulators is found to have potential for significant positive and negative effects. The same applies to large companies. As investors, licensors and customers they can accelerate growth of early stage businesses, but pitfalls are also flagged: they can divert attention, impose transaction and litigation costs, and shape value capture and regulation to the detriment of early stage companies.

One of the most interesting unique and timely contributions of this report, somewhat hidden in Section 6, explores the influence of entrepreneurs themselves on the eco-system. Detailed research in Argentina, Jordan and Turkey clearly demonstrate 5 roles through which entrepreneurs influence the entrepreneurial ecosystem for others:

- Inspiration – inspiring other individuals to become entrepreneurs

- Founder crucible – attracting and developing employees who subsequently found other companies

- Employee crucible – attracting and developing employees who subsequently become employees of early-stage companies

- Investment source – using acquired wealth to invest in subsequent new entrepreneurial ventures

- Mentor – providing key support such as advice, encouragement and access to a network

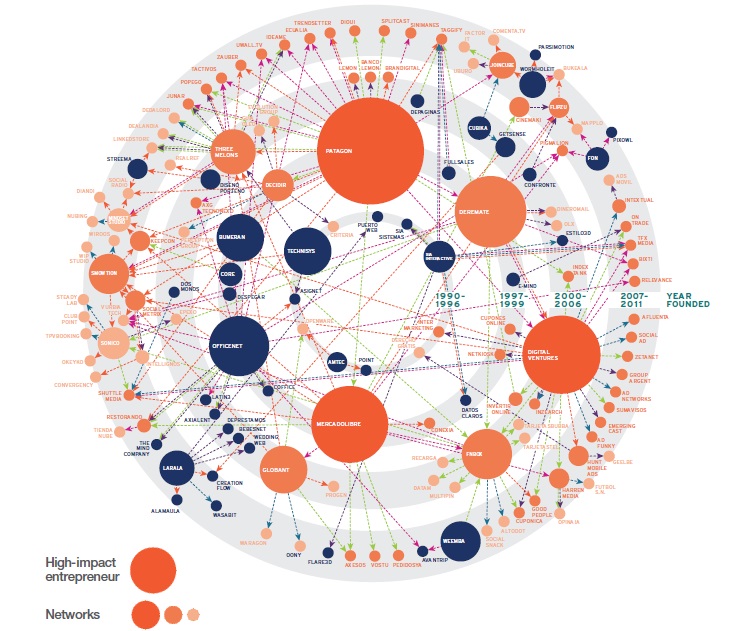

Connector maps are used to illustrate how the number of players and linkages between them have grown over time, highlighting ‘high-impact entrepreneurs’, networks and types of roles. The image here is an example for the Buenos Aires Technology Entrepreneur system:

Entrepreneurial Ecosystems was written for the World Economic Forum, and certainly has the depth of data and analysis to warrant its position there. Impossible to sum up in one short blog, there is data there for anyone interested in start-up enterprise. Including the 43 case studies, it is 240 pages long, but each section has an executive summary. The case studies add refreshing practical examples to the wealth of data.

Numerous implications could be drawn for policy makers, though are left implicit: focus in on what entrepreneurs say matters, and say is lacking in their area; focus on access to markets, workforces and finance; recognise the positive and negative roles that government and large companies play, working to boost those that accelerate start-up growth while tackling those that mitigate it; and finally to recognise the role of high-impact entrepreneurs themselves in creating strong ecosystems for others.

Further information

Entrepreneurial ecosystems around the globe and early-stage company growth dynamics is a World Economic Forum report, produced by teams from WEF, Stanford University, Ernst and Young and Endeavor.

Eighteen percent of the survey respondents are from the global South, and 60% of the case studies. The only southern countries with specific scores for the strength of their entrepreneurial eco-system are (listed in descending order of their score): Singapore, Pakistan, Mexico, India.

The report regards an entrepreneurial ecosystem as a system of interrelated pillars that impact the speed and ability with which entrepreneurs can create and scale new ventures in a sustainable way. (page 9)

For previous month’s Editor’s Choice selections click here