Key Challenges for the “Missing Middle” in Kenya

Kenya is the largest economy in East Africa with GDP growth rates constant between 6% and 7% for the last 5 years, a strong entrepreneurial culture and increasing number of innovative tech start-ups cementing its reputation of being Africa’s “Silicon Savannah.“ An increasing number of success stories have made Kenya the most attractive private equity market in the East African region. According to Intellecap’s research since 2012, venture capital funds have committed US$ 93m and since 2010, private equity investors have US$ 862m under management in Kenya. However most of these are focused on the high growth start-ups particular tech and financial services.

While Kenyan SMEs provide 80% of the country’s employment and contribute to 20% of its GDP, making the sector a major contributor to socio-economic development, the growth of the sector is hampered by limited access to finance. In spite of a landscape of service providers, including nine microfinance banks, 23 credit-only MFIs and 43 banks, there are critical gaps in serving different SME-segments, especially the enterprises in the ‘missing middle’ that are too big for microfinance and too small for private equity and debt.

Kenya’s SMEs – No One Size Fits all

A key challenge for providing financial solutions to Kenya’s SMEs is the lack of data and coherent definitions: There is much debate on the size of the sector ranging from 2.3m SMEs (IFC estimate) to 12.6m excluding the agriculture sector (MSME authority estimate). Moreover, 90% of the businesses in Kenya are unregistered and operate in the informal sector. Further difficulties arise as there is no widely accepted SME definition amongst stakeholders.

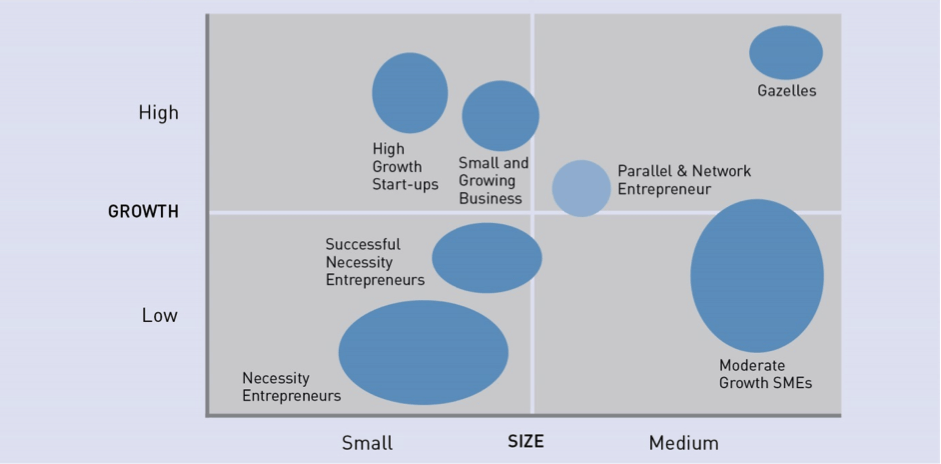

Our research focused on the missing middle i.e. those SMEs employing 5 to 250 persons with capital needs ranging from US$ 20,000 to US$ 2m, which is too big for micro-finance providers and too small for banks or private equity players.

Analysing the perception of the SMEs in Nairobi, Nakuru and Mombasa revealed that SMEs are not a homogenous group: Seven segments were identified of SMEs that differ in size, maturity and economic performance:

- Necessity or subsistence entrepreneurs (Jua Kali sector) – motivation is income generation.

- Successful necessity entrepreneurs- informal and run their micro enterprise sustainably.

- Parallel or network entrepreneurs- run multiple businesses and grow horizontally.

- Low or moderate growth enterprises – often in manufacturing, agribusiness or trade.

- High growth start-ups – often in the tech and services sectors.

- Small and growing enterprises -have growth and expansion potential.

- Gazelles- mature in their life cycle, but show continuous high growth rates.

Capital is the challenge: 68% of Kenyan SME self-finance their business

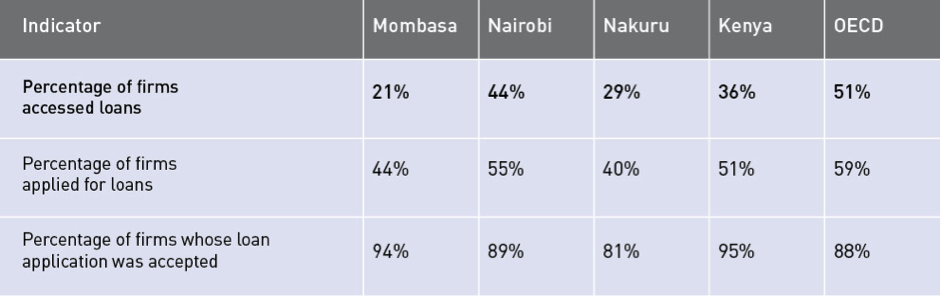

SMEs require finance for expansion, productivity and growth yet the majority self-finance their businesses. Analysis of the World Bank Enterprise Survey Data 2013 suggests that close to 68% of Kenyan enterprises state access to finance as a challenge. According to the Survey, 50% of Kenyan SMEs have never approached a bank and only 36% of Kenya’s SMEs have accessed loans, compared to the OECD average of 51%.

Four key gaps in the financing ecosystem have been identified

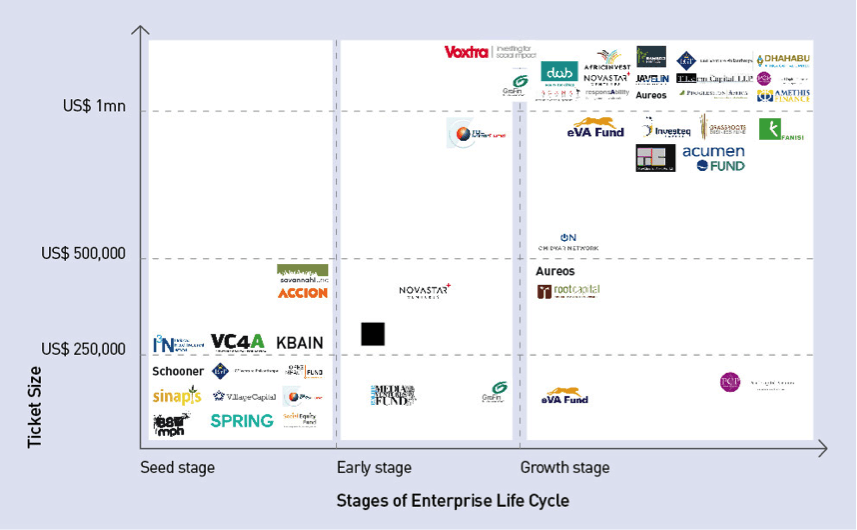

1. Lack of Seed and angel capital

Whilst angel investing is a recent trend in Kenya, with approximately US$ 10m invested in Kenya since 2008 across 82 investments, Angel investors fund only 2% of Kenyan start-ups most of which are in the ICT sector[1]. The amount of investment is quite small, 40% have received less than US$ 1,200 in funding and only 7% have received more than US$ 120,000[2]. Key challenge restricting the expansion of angel investing activity is the lack of awareness. Angels find it difficult to identify viable investment opportunities and enterprises are often unaware of the benefits of angel investors.

2. Lack of Long-term growth capital

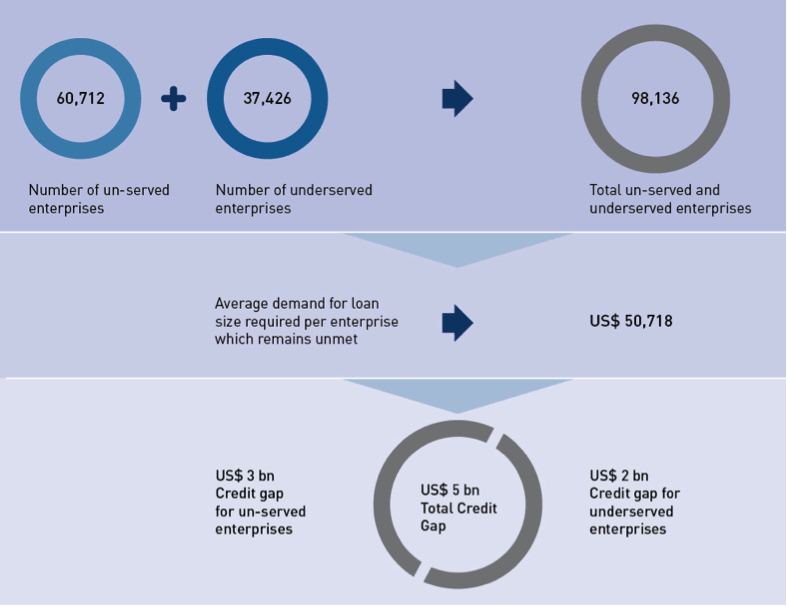

Patient growth capital is a challenge for most SMEs. The return expectations of private equity (PE) investors are around 20%, which the majority of SMEs cannot meet. Banks meet only part of the SME demand for capital. Despite increased efforts to lend to SMEs, Intellecap’s analysis indicates that there is a total credit gap of US$ 5bn for SMEs. Among the biggest challenges on the supply side is the lack of customized products, the inflexible collateral definition, high collateral requirements and high interest rates of around 18%. On the demand side, SMEs often lack awareness about products, struggle with investment ready financial models, or have challenges articulating their business plans.

Source: DGGF 2015 (Intellecap research)

3. Lack of Affordable, high quality business support

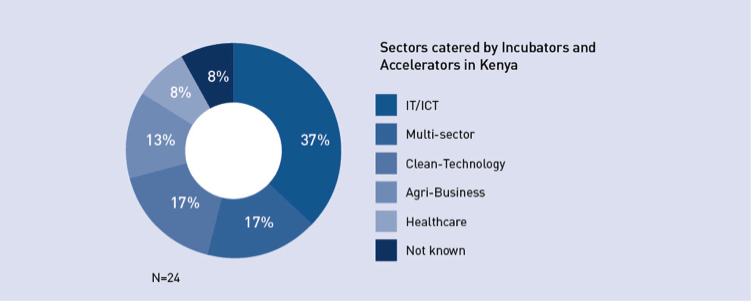

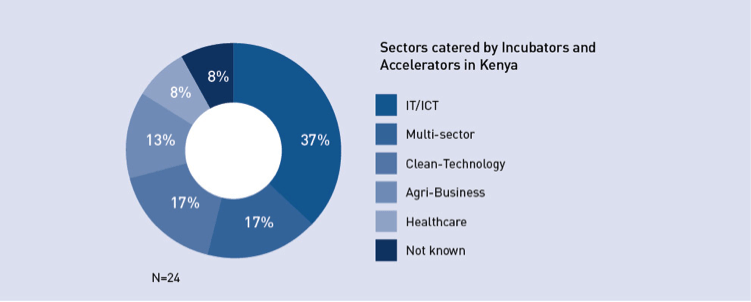

A recent enterprise survey by Monitor Group showed that only 30% of Kenyan enterprises believe business support meets enterprise needs, only 13% believe that services are affordable and 33% believe that services deliver value for money. On their journey to scale and investment, SMEs require a continuum of support services. These include accounting services, legal advisory & transactional services, incubators & accelerators, business associations and networks & platforms. Whilst a diverse landscape of non-financial service providers have evolved in Kenya with 24 incubator-like organisations these are mostly in Nairobi and focused on the ICT sector. The support ecosystem outside Nairobi and in other sectors is still nascent.

4. Lack of linkages in the ecosystem

While there is an increasing number of service providers and initiatives that target SMEs, the ecosystem remains fragmented and information on support opportunities is difficult to access. Linkages between initiatives are needed to help enterprises navigate the increasingly complex ecosystem.

Innovative service providers fill these gaps

Whilst SMEs face many challenges to raise finance from traditional debt and equity markets, there is an increasing number of stakeholders who aim to fill these gaps.

- Angel networks such as Kenya Angel Investor Network (KAIN), Viktoria Solutions or Intellecap’s Impact Investing Network aim to fill the critical early stage funding gap.

- Innovative service providers such as Grofin provide mezzanine finance, hybrid solutions with lower collateral requirements, fixed interest rate but convertible to equity in case of default.

- Impact investors such as Novastar Ventures provide capital as well as critical advisory services.

- Platforms such as VC4Africa leverage technology to match enterprises and investors.

- Incubators such as GrowthAfrica provide services beyond tech. SPRING Accelerator is targeted at business solutions that strengthen women empowerment.

- Specialized service providers such as Open Capital Advisors and Intellecap help enterprises to get investment ready.

- Platforms that bring enterprises, investors and other ecosystem players together such as Sankalp Forum drive the ecosystem and help entrepreneurs and investors to find each other.

Conclusions

Kenya’s entrepreneurial ecosystem has evolved over the past 5 years and there are many innovative organizations with different approaches to cater to the ‘missing middle’. Joint efforts are needed to turn the following recommendations to action:

- Make information about start-up support more accessible- Through tech-enabled information platforms, portals and other market infrastructure.

- Unlock angel investments from local high net worth individuals and diaspora- Address framework conditions for investing, attract capital from outside the country, prevent double taxation, restrictive repatriation laws, and engage in policy advocacy.

- Increase the supply of mezzanine finance- Work with banks and other key players for hybrid investment products to address the long-term growth capital gap.

- Combine financial with non-financial support- Strengthen collaborations among ecosystem players through media platforms, business networks and industry gatherings.