Social impact: going beyond just business as usual in Asia

In February 2016, inclusive business pioneers and thought leaders from across Asia came together to share ideas, experience and knowledge at the Asian Development Bank's (ADB) 2nd IB Asia Forum in Manila, Philippines. The result was four days of lively discussion, collaboration and questioning on the state of inclusive business in the region and where it is heading. While the importance of inclusive businesses (IB) reaching commercial viability was heavily emphasised at the Forum, social impact and the need for impact to go beyond ‘business as usual’ was also highlighted. Enthusiasm for the social impacts that inclusive business delivers united Forum participants, as did the need to scale it up, but there were tricky issues to discuss when it came to defining social impact.

Two areas of nuanced discussion were around:

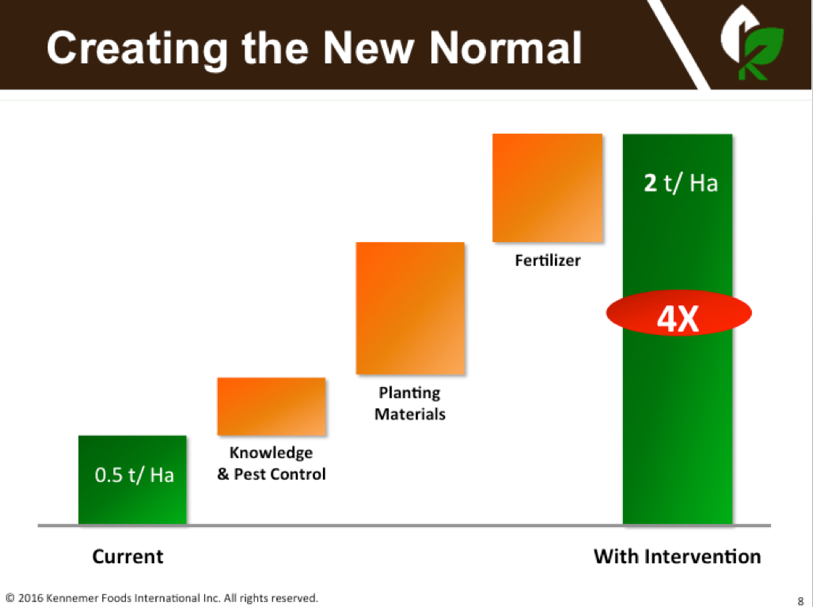

- The extent to which engagement of low-income people should be ‘better than existing practice’ or better than ‘just engagement as producers or consumers’. While some players might argue they were doing inclusive business all along because they buy from farmers, the ADB definition emphasizes that prices or wages should give farmers a premium over ‘business as usual. Inclusive business should represent a net gain. For example, Rocky Mountain Coffee showed calculations of how farmers net income per ha would multiply compared to conventional coffee farming.

- Criteria for assessing the social impact of inclusive business. Social impact is much harder to define or calculate than financial return. To attract capital or government support, it needs to be clearly demonstrated and assessed. Discussions went beyond recounting the number of people reached, to also highlight other aspects of social impact, including relevance to problems of the poor, depth of impact, and who is reached. Discussion highlighted the need to do this 'ex ante' to feed into investment decision-making and investment design.

Figure 1: Kennemer Foods’ slide illustrating net farmer gain from its inclusive business project

Companies gave the following examples to assess their “reach”

- Manila Water, for example, has added 3.3 million customers to the water network, 1.8 million of them via Tubing Para Sa Barangay, targeting base of the pyramid (BoP) households.

- eKutir reaches 60,000 Indian farmers with support to their farming enterprise. Through its sanitation initiative ‘Svadha’, eKutir has reached more than 8,000 households through 100+ micro entrepreneurs.

- Mynt Globe has 1.5 million customers, transacting 1 billion PhP per week (US$2.1 million), and 10,000 customers have loans so far.

- Entrepreneur Finance Lab, providing an online tool for credit scoring of low-income people with no credit history, has clients in 27 countries, and these financial institutions have reached 41,000 customers so far.

- Yes Bank in India has provided small loans to 2.3 million women borrowers in three years.

How much impact is enough? While eKutir explained their impact on 60,000 farmers that gain access to input, training and information, a former ADB banker argued that it’s not enough in the context of hundreds of millions of poor people in India – and not necessarily enough to convince DFIs to invest. While 60,000 is high for any single company, the question comes back to the heart of ADB’s definition of inclusive business: business models that can scale and create systemic change.

Figure 2: Slide by Manila Water demonstrating its growing reach

Figure 3: Types of impact: income, costs saved, time saved, living standards

Impact comes in many forms: earnings, money saved, time saved, improved living standards, or respect.

Money saved: Migrant workers sending remittances home usually lose 7% in transaction costs – equivalent to losing an entire month’s wages each year. Coins.ph explained how blockchain technology slashes that to just 1-3%, leaving more in the pockets of their families.

Time saved: Coins.ph which enables Filipinos to make money transfers by phone. The majority of customers would otherwise have to travel significant distances to a bank using up much of a day, to make a transfer. The majority of Coins.Ph users are women aged between 25-34, for whom such time savings have huge value.

Living standards: Agribusinesses including eKutir in India and CJ Group sourcing in Vietnam, found they had to go beyond agricultural improvements, to tackle other issues which affect productivity, such as sanitation or health.

Respect: Waste Ventures working with waste pickers in India, found that trust and respect, more than money, are important to secure the services of waste pickers.

When ADB screens deals as an inclusive business investment, it assesses both financial and social soundness. One problem in the inclusive business space is that the term is applied to different types of deals. However, discussion of the need for ex ante impact assessment suggested that core types of criteria could be harmonised across investors, although each would develop their own application and threshold. Based on the ADB approach so far, the core categories for screening should be:

- relevance to the poor: eg. whether it solves a problem of poverty (which problem);

- potential to have impact at scale;

- who benefits and how much they benefit (including whether the model has a net poverty impact that is beyond business as usual);

- potential for systemic change, beyond the deal itself.

These criteria could be adapted for different types of deals and investment objectives, but probably each of them is relevant to an investor in inclusive business and should therefore be part of decision-making.

The information presented in this blog is adapted from 'A gathering of pioneers', the report on the 2nd IB Asia Forum 2016 which takes an in-depth look at the key themes discussed and the implications for Asia. View all the speaker presentations on the IB Asia Forum pages. Visit the IB Asia Hub for more on inclusive business in the region.

Other blogs in the series include:

- A gathering of pioneers: new report highlights key trends in inclus...

- Moving towards a robust support ecosystem for inclusive business in...

- The unique role of development banks in inclusive business

- Inclusive business trends in South Asia and South East Asia

- What sort of financial return are investors seeing from inclusive b...

- Tackling the risk or ‘perceived risk’ of inclusive business investm...

This blog is part of the July 2016 series from the Practitioner Hub and Seas of Change on Inclusive Agribusiness. Download the PDF for more insight, updates and opinion.