Sustaining our Oceans: A Role for Investors in Achieving SDG 14

With the launch of the United Nations Sustainable Development Goals last month, countries have set an ambitious agenda to end poverty, protect the planet, and ensure prosperity for all over the next 15 years. Among the 17 goals, SDG 14 focuses on conserving and sustainably using the oceans, seas, and marine resources for sustainable development, including a range of targets from reducing marine pollution and protecting coastal ecosystems to ending illegal fishing and addressing the impacts of climate change on the oceans.

These issues have very real ecological and economic costs. According to the United Nations Development Programme (UNDP), overall, the impacts from overfishing, coastal hypoxia and eutrophication, invasive aquatic species, coastal habitat loss and ocean acidification cost the global economy at least US$350 billion – US$940 billion every year.

Coastal and marine issues cut across sectors and geographies. Consider marine pollution, for example, which does not obey geographic boundaries and can have negative impacts on fisheries—another transboundary concern. Conventional approaches, which address issues separately, on a sector-by-sector basis, are not sufficient for solving complex ocean challenges. Integrated coastal management (ICM) is one proven approach to successfully coordinating various coastal and marine management efforts, addressing the governance of human activities affecting the sustainable use of goods and services generated by coastal and marine ecosystems.

Partnerships in Environmental Management for the Seas of East Asia (PEMSEA) has seen over its 20 years that ICM results in a host of ecological and economic benefits. In Xiamen, China, one of PEMSEA’s first ICM sites, the waterfront was suffering from severe pollution and sea use conflicts in the 1980s. Over several cycles of ICM, the coastline of Xiamen has been transformed into a model for ecological and economic success, providing opportunities for leisure and tourism, residential real estate, a venue for industries and a home for rich biodiversity, including the return of the Chinese White Dolphin. According to one study, every dollar invested in ICM in Xiamen has returned seven dollars in economic benefit to the city.

Integrated approaches that include scaling up investments in coastal and marine sustainable development will be critical for achieving SDG 14. PEMSEA will be launching an updated Sustainable Development Strategy for the Seas of East Asia (SDS-SEA), a regional marine strategy between 14 countries that considers SDG 14 and includes a call for increased investments. Overall, available funds for ecosystem services and biodiversity remain small in comparison to the actual human cost of consuming, restoring, maintaining and managing these vital resources. By some estimates, the financing gap exceeds at least US$ 300 billion per year and may reach into the trillions.

To better understand the current state of investment in ICM, PEMSEA is partnering with IIX and Shujog to develop a study assessing the current financial funding flows of an estimated US$ 10 billion to ICM-related sectors across the grants and investment capital spectrum in 8 countries in East Asia. The study identifies regional and country-level trends in ICM funding from bilateral and multilateral donors, foundations, development finance institutions, corporations, impact investments and commercial investors across ten related coastal and marine sectors.

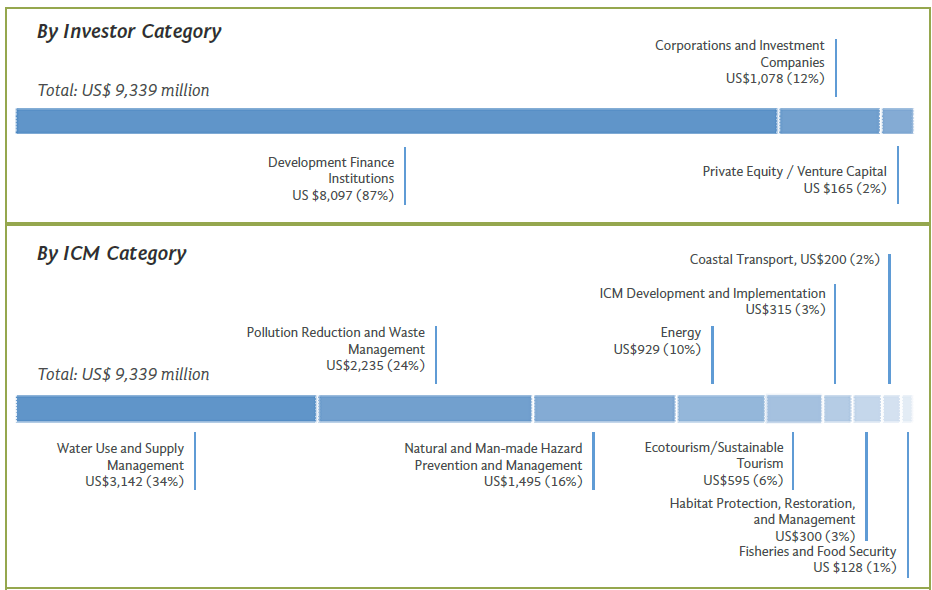

Our findings indicate that in the last decade, countries analyzed in this report welcomed an estimated 111 ICM-related investments from 23 investors providing upwards of US$ 9.3 billion in financial commitments. Development finance institutions dominate ICM-related funding by a wide margin, followed by corporations and investment companies and private equity and venture capital funds, a relatively nascent investor group in ICM across East Asia. Committed funds went to a variety of private sector enterprises and initiatives in the ICM sphere, including seafood processing companies, desalination and waste treatment technology, ecotourism initiatives and coastal energy projects.

Across impact investing, which seeks to generate measurable social/environmental impact alongside financial returns, a conservative estimate places assets under management (AUM) for impact investments at US$ 46 billion globally. ICM reflects a relatively new area of interest for impact investors, who traditionally look to microfinance, financial inclusion, energy, healthcare, agriculture, livelihoods and education. While a small percentage of these investors have made investments in conservation across East Asia, a recent study points to rapidly growing interest among impact investors for the conservation investment market, which includes marine and coastal conservation.

There is significant potential for impact investing to begin addressing some of the ICM funding gap, and the universe of investors active in ICM is likely to continue growing. Recent efforts like the US$ 53 million Vibrant Oceans Initiative funded by Bloomberg Philanthropies, which incorporates a private capital financing strategy, can help to continue expanding engagement of impact investors in ICM sectors. The emergence of climate investment funds, marine payments for ecosystem services, biodiversity offsets, and “blue bonds” for the ocean space, point to creative mechanisms that can help scale initiatives for sustainable coastal and marine ecosystems.

There is no shortage of investment capital available, but investors frequently cite difficulties in sourcing high-quality investable projects in ICM-related sectors. Building on its work across East Asia over two decades, PEMSEA is launching a regional platform in partnership with The World Bank for scaling up investments in ICM. The PEMSEA Network of Local Governments has already identified more than 200 potential investment projects at ICM sites across the region. This new platform, the Seas of East Asia Knowledge Bank, will support project developers in assessing their investment-readiness and preparing investable projects that can be discovered by investors.

The full report and a beta version of the platform will be launched at the East Asian Seas Congress 2015, the region’s largest event focused on coasts and oceans, held Nov 16-21 in Danang, Vietnam. A special session will be held on November 18 focused on Investing in a Blue Economy for Conservation and Impact. Featuring a keynote presentation by Prof. Durreen Shahnaz, founder of IIX and Shujog, the event will include presentations and discussion with impact investors, development finance institutions, companies and government officials on the potential for scaling up investments in sustainable development of coastal and marine areas.

This article is written by Ryan Whisnant (Head of Professional Services at PEMSEA) and was first featured in the Impact Quarterly.

This post is a part of the March 2016 series on Inclusive Business and the Sustainable Development Goals. View the whole series for more examples, tools and insights to help you understand what the SDGs mean for business.