Want to know more about Kibera? Artificial Intelligence can help

How many people live in Kibera?

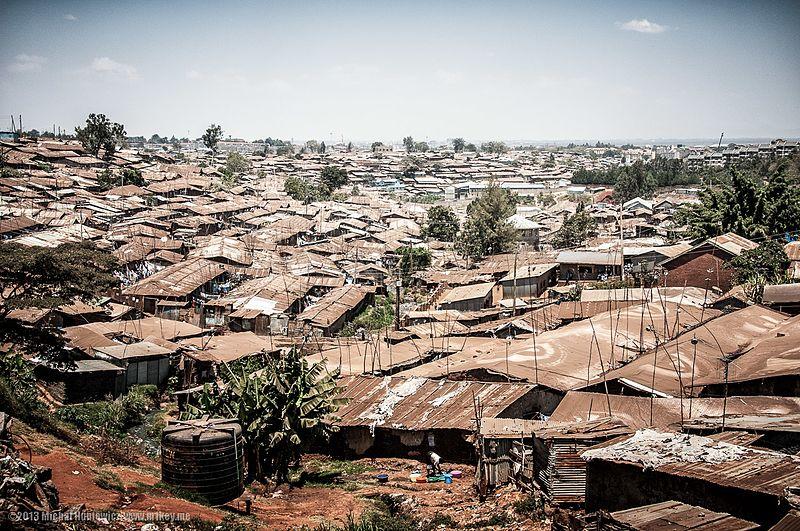

For a long time, Kibera was considered the biggest slum not only in Nairobi, but in all of Africa, with allegedly over 1 million inhabitants. The 2009 Kenya Population and Housing Census counted 170.070 inhabitants. In 2010, UN Habitat estimated Kibera’s population at 500.000 to 700.000. Such is the quality of data for many, if not most low-income markets in developing countries. If we don’t even know how many people live in a certain area, imagine how little we understand about their incomes, spending patterns, or consumer preferences. Low-income markets remain dark data-wise.

What can artificial intelligence (AI) do for market research?

AI provides algorithms to automatically identify relevant information on the internet and analyze its content for specific uses. It enables enterprises to make better informed business decisions and develop services or products that exactly meet the needs of their target group. It can complement or even save businesses costly and time-intensive market research.

Why do we need BoP market data?

Companies and investors still cite the lack of market data as one of the major impediments to investing in low-income markets. Without a solid understanding of the income and spending patterns, preferences and challenges of the low-income target group, it is difficult to calculate a robust business case, find the appropriate price point, or identify the best market segment. As a result, companies either stay away from the market, or face high upfront costs for market research that they may not be able to recuperate if they don’t find the expected market demand.

Without data, investing becomes a gamble.

Companies and entrepreneurs building new business in low-income markets usually collect their own data via surveys. This is expensive, and usually leads to poor quality of data because respondents often answer strategically, or do not understand the question or do not know the answer. The best way to find out whether a product will be bought and for what price is to sell it, leaving entrepreneurs reliant on a costly and lengthy trial-and-error approach. Business plan calculations for revenues are pure guesswork at this stage. Not only the entrepreneurs, also the investors know this. Besides “patient investors”, who are sometimes not even expecting to get their money back, capital for early stage entrepreneurs is extremely limited. In the absence of reliable numbers, investors understandably want to see a solid financial track record of multiple years before they provide equity or even debt capital.

Accurate, deep and up-to-data data could unleash investment in low-income markets.

And the good news is: this data is already being collected. Off-grid energy providers measure when energy is used and on which devices. They also receive payments from their customer’s mobile phones and hence know who can pay reliably, and who can’t. Mobile money operators register billions of transactions by low-income customers, receiving salaries, paying for water, buying soap, or sending money to relatives. Mobile money service MPESA processes 6 billion transactions in 2016.

In addition, public organizations like the World Bank or national governments commission hundreds of reports each year that highlight earnings, spending and consumption patterns of people living at the BoP. This data, however, is often difficult to access and too high-level. Combining the data sets of public and private players would make the BoP market a lot more transparent and accessible for companies and investors.

AI can digest the available “big data” into useful market information.

By combining different sources of data and analyzing it using smart algorithms, we can now create much more reliable data on an ongoing basis. This requires collaboration between the various organizations providing data as well as artificial intelligence experts. Ideally, investors come in at an early stage to specify their demand for data.

First steps: providing access to AI tools

The ii2030 initiative on improving BoP market data brings together energy companies, donors and investors to seize this opportunity. In a first step, it will create a platform that makes existing AI-based tools for data collection and analysis available to companies and investors. Are you interested in joining this initiative? Do you know relevant tool, or are you already using some? We are looking forward to hearing from you!

This blog is a part of the November 2017 series on data for inclusive business.

Read the full series for insights on how the data revolution could affect inclusive business. Will it bring an end to the uncertainty of business in Base of Pyramid markets? Can it straddle the development-business divide? Will the data drive spurred by the Sustainable Development Goals be useful to inclusive business?