WEE and Enterprise Development in SE Asia - Lessons from GRAISEA

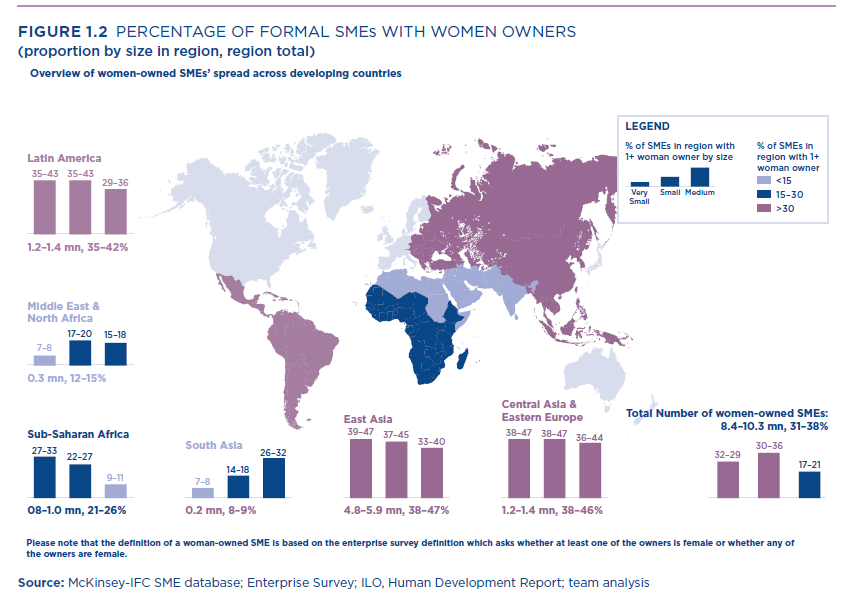

According to a joint study done by McKinsey and the International Finance Corporation (IFC)[i] there are an estimated 365 to 445 million Small and Medium enterprises (SMEs) in emerging markets. Looking at data from Women’s World Banking’s research on SMEs in SE Asia, there are approximately 23.9 million women run and owned business in at least five countries (Vietnam, Philippines, Cambodia, Myanmar, Indonesia) alone. At the same time, they are also the segment that faces the harshest challenges in terms of accessing credit, not just due to asset ownership but additional issues such as cultural bias, gender norms and social structures in many countries.

Oxfam’s flagship Regional program "Gender Transformative Agricultural Investments in South East Asia" (GRAISEA) , which engages with the private sector and the financial sector to invest responsibly in agriculture value chains through innovative investments (Impact Investments) in small and medium enterprises, provides some lessons. Below we focus on two areas: mentorship and access to finance.

Mentorship - Training mentors to speak ‘with’ women

The GRAISEA program understands that Women Led Enterprises face multiple barriers. Therefore, it has created a network of country based expert mentors called Global Impactors Network (GIN) to support enterprises (Co-Ops, CBOs, SMEs) to help them resolve some of the business-related challenges they may face.

GIN helped scale the women led Fisher Folks Network (FFN) in Thailand. The intervention increased revenue from USD6k to 18k per month. However, the key learning was that, although the mentors were high level experts, their initial engagement with the women entrepreneurs was not resulting in successful outcomes. This was due to cultural issues where the mentors talked “at” the entrepreneur and not “to” or “with” them. For example, one of the mentors is an owner of a restaurant group in Thailand and was completely unaware of the obstacles to effective impact on the women from the FFN, which eventually surfaced as their lack of confidence or financial knowledge, perceived or real, by the members of the FFN. Oxfam and its partner Change Fusion Thailand quickly saw a pattern emerging with other male and female mentors as well. This resulted in the need for the mentors to go through gender and communication training. The intervention then created a pathway for more effective communication which led to the revenue acceleration. The FFN ,with the help of Oxfam and Change Fusion, is in the process of converting from a CBO to a Social Enterprise.

Access to Finance

Access to finance continues to be a challenge for SMEs led by women. This is especially true in the case of SE Asia.

If we were to drill down even further, then access to finance in the ‘missing middle” space for women-led SMEs is even more challenging. The missing middle is usually defined as enterprises that are too large for MFIs and too small for commercial banks. Lack of funding in that space is exacerbated due to banks being risk averse, lack of data and high transaction cost amongst other items. The GRAISEA program has tried to use several approaches to bridge this challenge. The results have been mixed.

Impact Investment

The GRAISEA program raised USD 350k for Kakao Chocolate, which impacts 4,500 producers, of which close to 50% are women. However, this model of attracting capital to support the credit gap may need further assessment to record actual impact on women. Additionally, the cost of the impact assessment and the Technical Assistance provided comes at a very high cost. Due to the high cost, this approach of capital raised may not be sustainable for missing middle enterprises in the agriculture sector. However, as the impact investment market develops and defines it’s focus we may see a reversal of the trend.

Additionally, learning in this space suggests financial intermediaries are looking to add to their impact enterprise pipeline. Therefore, due to the pressure from investors to show impact on women, a lot of the capital may be at risk of being diverted to investing in Micro Finance Institutions (MFIs), as they may be the easiest way to show gender impact.

Social Impact Funds

GRAISEA supported enterprises that empower women but may require further grant based investments to scale up the enterprise ladder to access equity/debt based investments. In the case of Thailand there are a few innovative closed-end funds that are emerging for that purpose. One such fund is the B-Kind fund which recycles 40% of its income towards social purpose enterprises. The Fisher Folks Network (FFN) in Thailand could access approximately USD 38k in working capital from the B-Kind fund successfully. Once again, the lessons that are developing from GRIASEA point towards domestic capital markets being able to provide funding.

Going forward GRAISEA may address deeper issues related to the financing gap in Women Empowering Enterprises in South East Asia. For example, the role of the DFIs and IFIs in providing capital to national banks to lend to women entrepreneurs and the funds not reaching its constituents.

New Trends

The good news is that the challenge for women SME owners is acknowledged by different stakeholders. Unlike the past, right now there is critical momentum in the South East Asian to solve some of these issues.

Emerging Trends

Bonds

The Women’s Livelihood Bond (WLB) backed by USAID’s DCA guarantee and created by IIX (Singapore) has raised USD 8million at 7%. The proceeds will support SMEs that impact women and micro finance institutions that provide capital to women entrepreneurs.

Angel Investors

There is rise in the angel investment space in SE Asia. For example, Angels of Impact based out of Singapore is actively supports women led enterprises in the ASEAN region. They provide capital and technical assistance to several enterprises. Additionally, they provide market access to women led enterprises into the Singapore market, through their network which includes Linkedin and Facebook.

In conclusion, opportunities for support for women empowering enterprises continue to evolve in South East Asia, now at a faster pace than before.

This blog is a part of the September 2017 series on Empowering women, in partnership with SPRING.

Read the full series for insights on business models that empower girls and women, a new analysis of gender impacts of value chain interventions, tips on gender-lens investing and many inspiring personal stories from women.