What drives inclusive business, and what gets in the way? The key commercial drivers of Business Call to Action initiatives and the challenges they face.

There is plenty of debate, ranging from the enthusiastic to the sceptical, about what drives companies to do good while doing business. The recent review of the Business Call to Action (BCtA) membership was a chance to ask a wide range of entrepreneurs themselves about the commercial drivers behind inclusive businesses.

The BCtA network brings together 94 companies seeking to achieve both commercial success and development impact through their inclusive business commitment. Forty nine responded to a survey where they indicated their commercial motivations, and also the challenges they face in implementing inclusive business.

BCtA initiatives were generally core to business and long term strategy, but not necessarily key to the bottom line. Close to a third of the 49 initiatives that shared information on their commercial drivers identified ‘profit, productivity or cost reduction’ as an important driver. Marketing and strategic drivers were more common, with ‘access to new markets’, ‘first mover advantage’ and ‘differentiation from competitors’ all frequently cited as priorities.

Where initiatives were seen as core to the bottom-line, the vast majority of companies were ‘emerging’ – younger companies with a fundamental focus on bottom of the pyramid markets or value chains (this ‘emerging’ category is explained by Lara Sinha here). For BCtA members companies that are large and well-established (and often multinationals), meanwhile, drivers were more strategic, and ranged quite widely.

Table 1: Commercial drivers prioritised by initiative, by company type.

Progress in reaching drivers

Businesses were fairly positive in their assessment of initiative performance in meeting these drivers. The below chart ranks the degree of success so far for the commercial drivers prioritised by 10 or more BCtA initiatives. ‘Innovation into new business lines’ appears to be the main success story, while a large proportion of initiatives also observed strong performance in accessing new markets, and setting themselves apart from competitors.

Figure 1: Have commercial drivers been delivered? (0 not yet evident, 10 =strong delivery)

Challenges

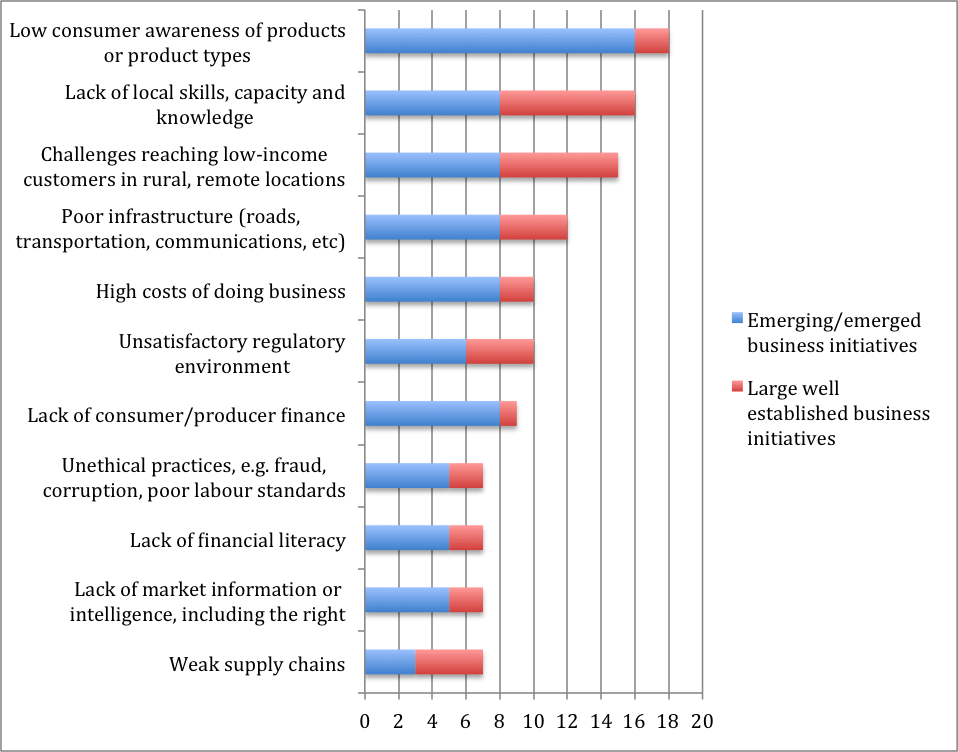

We also asked businesses to identify the challenges they faced with their initiatives. Again, there were notable differences between the challenges faced by emerging companies and large well-established companies, however the broad challenges of developing commercially viable business models and coping with low returns on investment were a consistent theme with both.

The major challenges for emerging companies centre on securing customers and on generating capital. Half the emerging companies surveyed flagged up ‘low consumer awareness of products’, while ‘reaching a low enough cost point’ came a close second, tied with ‘finding sufficient internal resources and finance’.

A ‘lack of local skills, capacity and knowledge’ was the most frequent challenge amongst large, well-established companies, reflecting a focus on supply chain initiatives. These initiatives also frequently raised the challenge of establishing commercial viability. The graphs below show the key external challenges faced by BCtA initiatives in their value chains and markets at the base of the pyramid, and the main internal challenges within BCtA businesses. For more on the common challenges faced by inclusive businesses, see Caroline Ashley's blog based on 3 different samples covering 150 co...)

Figure 2: Key external challenges faced by BCtA initiatives

Figure 3: Key internal challenges faced by BCtA initiatives

It is worth noting that although there are plenty of challenges, covering the real fundamentals of developing a strong commercial proposition that delivers positive social impact as well, there are also plenty of promising signs for the BCtA portfolio as initiatives mature. Half of the initiatives have already reached break-even. More than two thirds (69%) of the initiatives surveyed reported they were ‘on track’ or ‘flourishing’, 18 initiatives report reaching a million or more beneficiaries, while 23 report revenues of over $1million.

About ‘Breaking Through’

‘Breaking Through: Inclusive Business and the Business Call to Actio...’ is authored by Caroline Ashley and Suba Sivakumaran, in conjunction with Tomohiro Nagasaki, Lara Sinha, Suzanne Krook and Tom Harrison. Joe Shamash conducted the online survey and led the data analysis. Five years on since BCtA was launched, it reviews progress made by BCtA members and the strategies they are adopting. The report covers BCtA members’ 94 initiatives and draws heavily on surveys and interviews conducted with 49 initiatives during mid-2014. Join our discussion on social media using #BCtABreakingThrough