What impacts can we expect from inclusive businesses supported by BIF?

A snapshot of the Facility’s project portfolio one year after start-up has given us the first real sense of the impacts that could be delivered - albeit a very preliminary picture.

BIF support to inclusive business projects is expected to help companies deliver both commercial and developmental returns. More business, more opportunites for people at the base of the pyramid, and faster development. But what types and scale of impact can we really expect? This is a poorly understood field.

BIF input delivers 2 types of development impact:

1 - direct results for Base of Pyramid (BOP) people - producers and consumers engaged in the IB projects.

2 - indirect systemic change , e.g. in private sector capacity for transformative inclusive business, markets operations, sector development trajectories.

Each of these has several components, emerging over the medium and long-term - so long as the business is commercial viable and thrives.

Variety of impacts evident in the portfolio

Although the portfolio contains 18 approved projects, we focus on the first 10 projects for understanding impact, as the baseline information and start-up phase provides richer detail. Trends in the first 10 projects:

- Primary direct beneficiaries in 7/10 projects are smallholder farmers, mainly as producers of crops, but also as consumers of services. In the other three projects, BoP consumers and entrepreneurs are the primary beneficiaries.

- Projects supporting farmers as producers aim to reach from 1,000 -8,000 in 3 years, usually by sourcing from them. In India, mKrishi aims to provide information services to hundreds of thousands of farmers.

- In one project, CARE/RSP, rural entrepreneurs are the primary beneficiary group, though entrepreneurs are a secondary group in many. RSP aims to engage 12,000 rural women as entrepreneurs.

- Projects reaching consumers as direct beneficiaries aim to reach many more: tens and hundreds of thousands, or more.

- Projects show many possible routes to systemic impact, mainly via development of their respective sectors.

- Systemic impacts go way beyond simply others copying their business model.

Direct impacts depend on commercial success and scalability

By the third year of operation, projects may be reaching 1,000 to 12,000 BoP people as producers, or 100,000 or even millions as consumers. However, what will really determine the number reached is the number of projects that go to scale eventually. The ultimate impact of each project, and of BIF, thus depends not just on direct BOP reach during the BIF lifetime, but likely trajectory towards scale

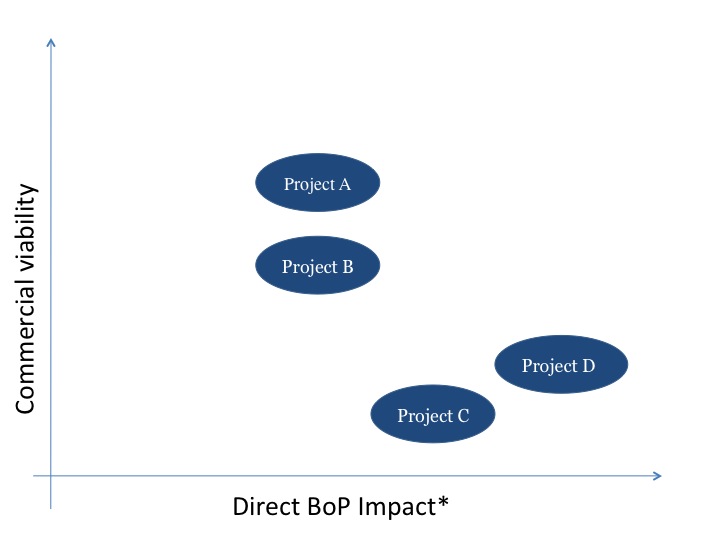

This means commercial viability is key. Some projects with higher returns also pose higher risks (see diagram).

Systemic impacts

Of the systemic impacts that can be anticipated so far, 2 broad categories stand out:

1. Capacity of the private sector for transformative business practice. This is not just the capacity of the BIF client to implement IB, but capacity of a wider range of business via demonstration affect, risk reduction, market frontier development, sharing knowledge

2. Enhanced sector development: uptake of new approaches or standards in the expectations and practices of others in the value chain, including consumers, workers, competitors and/or regulators. Uptake of the inclusive business model by others in the sector is one possibly type of impact, but only one of several.

We expect some projects to be strong on systemic impact but not so strong on direct BoP impact, and vice versa. This is illustrated in the diagram below, based on initial projections. Size of the bubble also indicates estimated potential to go to scale.

Commercial returns of BIF projects

The commercial returns will vary widely, reflecting the wide variation in the type of company supported, from multi-nationals to start-up businesses. The main elements are:

- Establishment and growth of start-up businesses

- Increased company revenue;

- Business growth, increased corporate value, via other objectives: expansion into new markets, competitive advantage, sustainability of supply chains, brand value.

At present, more than half the portfolio is start-up businesses. Estimated revenue growth during the first year is, in many cases, around £150,000 to £300,000. Estimates for Year 3 run into millions of pounds, but in most businesses it is too soon to make such estimates.

Finally, is important to draw on of impact evidence from other projects. Looking at inclusive business initiatives and challenge funds that pre-date BIF, we see that:

- It often takes around 5 years to reach ‘take-off’ where numbers of direct BOP reached go to the hundreds of thousands. So by year 3 of BIF, the direction and trend-line will be important, but it may be too soon to measure true scale.

- Most IB projects report numbers of BOP people reached; assessing how much they benefit in monetary or livelihood ways is rare. It is particularly difficult for a company to assess this.

- Systemic change and ‘knock-on’ affects caused by a project can be substantial, though very variable, and should not be ignored by overly focusing on direct numbers reached.

High variability between projects should be expected. Average results hide a fair share of ‘virtual failures’ a bulk of ‘steady trenders’ and a sprinkling of ‘winners’. The same is expected in BIF.

The review provides pointers for our future work, what to track, what to expect. Further details on BIF results and our monitoring mechanisms will be shared on the Practitioner Hub as this work develops.