Bankly

In Nigeria, Bankly brings people into the financial system. Through a network of local agents, it makes digital financial services accessible for low-income communities. This especially benefits women and entrepreneurs in the informal sector.

To start, can you briefly introduce yourself?

My name is Tomilola Majekodunmi, but I prefer to be called Tomi. I am a co-founder and the CEO of Bankly, a licensed payment service provider and microfinance bank in Nigeria.

What motivated you to found Bankly?

I understood that financial inclusion was directly proportional to poverty alleviation.

In Nigeria, I experienced two main challenges. The first one was the inability of financial services to get to the last mile while other fast moving consumer services such as alcohol, tobacco etc. could reach these same communities. So, I got involved with a research study with Accion. Second, I once experienced how a community lost its savings when a thrift collector ran away with their daily savings. (Thrift collectors, popularly called Alajo*, are agents who help to save in communities where there are no formal savings institutions and access to banks is limited. They do this by collecting cash in various markets and communities and provide a physical notepad to the saver for record keeping.)

How did Bankly address these challenges?

First, we digitized the informal savings process while partnered with a licensed commercial bank. This ensured that the money our clients saved was secure, independent of the local agent. Second, we leveraged this digital data to build credit information.

This process was growing organically until COVID disruption due to lockdowns of informal markets. Although our savings pool began to deplete, we were excited our savers had emergency funds that served as a buffer during this challenging period. Our agents also began to provide other financial services to the communities using point of sale terminals. All these made us realise how important a hybrid model is in order to serve the informal sector. the offline channels and distribution, was as important as the technology side. We went ahead to create a network of skilled agents network that enabled people to make payments or withdraw money in several communities nationwide.

Could you talk more about the consumer segments you serve?

About 70 per cent of our customers are from low-income communities. Many clients use Bankly to grow their enterprises in the informal sector. They can access affordable loans, save money, and make digital payments.

What is the special value you create for your clients?

Most people in underserved communities save money through informal thrift collectors (alajo*). As I said before, relying on alajos exposes them to fraud. Saving in cash is risky, too: due to damage, theft etc. we focus on bringing people into the financial system who otherwise have not previously trusted or have been excluded due to location of bank branches. We help them make and accept payments, grow their businesses and access affordable loans.

This impacts the whole society. Providing affordable financial services is at the backbone of poverty alleviation. It provides employment, income protection, improves economic activity and this, in turn, can lead improve access to education and we know what education can do a nation.

How do the agents profit?

Most of them come from underserved communities as well. We create decent employment for them. In addition, we provide financial literacy training, show them how to secure their digital wallets as well as how to run a profitable business.

How do you impact women?

The informal sector is powered by women, women are also the known users of the thrift collection system. Women in Nigeria are particularly entrepreneurial and hard-working but many defer and submit financially to their husbands even if they are the bread winners due to religious and cultural norms.

This could lead to financial dependence in societies where women are not already protected. Where polygamy and multiple children from multiple wives is culturally accepted. Women find ways to remain financially independent using these local thrift collectors. The more we do in this space, the more empowered they are. This is critical in a place that does not give them a lot of advantages.

How many people have you reached so far?

We have almost 40,000 agents/merchants and consistently serve about one million users. About 70 per cent of them are from low-income communities, and 47 per cent are women. Some of these people are savers, others transfer, withdraw or pay utilities through Bankly.

Recently, we applied for a grant to bring the number of women agents and customers further up. Right now, 28 per cent of the agents are women.

How do you measure the impact you create?

Over the last couple of years we have been blessed to work witj some impact organizations. Some of which have helped to frame how we track and measure our impact. We have worked with GIZ and also created our theory of change through INSEAD Cartier Women Fellowship program. This has been a helpful for us and important for companies first starting to measure their impact.

One of our key impact metrics is the number of people who are newly interacting with financial services. In addition, we measure how much credit we give to companies in the informal sector and the value of funds we are protecting against fraud.

What makes your business model commercially viable?

The size of the market. Nigeria has about 100 million adults, and existing banks only target the upper 30 per cent. Many new digital banks try to cut off a slice of this same pie. Below that, there is room for another 40 million people who can be served. We are very specifically targeting this segment.

Can you tell me the annual revenue of your business?

From the payment side, we are at about 2.5 million dollars annually, all from dealing with low-income communities.

We recently got a banking license and are pre-revenue for this part. Over the last six months, we onboarded over 200,000 users for a pilot and are excited about that.

Do you receive any funding or technical support from outside the company?

We raised a seed round of two million dollars in 2021.

How many people do you think you could reach in future?

Bankly launched its MVP in late 2019. Since then, we have been building the distribution and agent network. Now that we have a banking licence, our goal is to reach two million active users by 2024.

Also, due to the central bank’s new cashless policy which would affect a lot of merchants in the informal space where almost 90% of transaction is in cash. Our goal is to provide other payment channels for these micro-entrepreneurs enabling them accept digital payments through our platform.

What can you point to in your track record that demonstrates the potential for profitable growth?

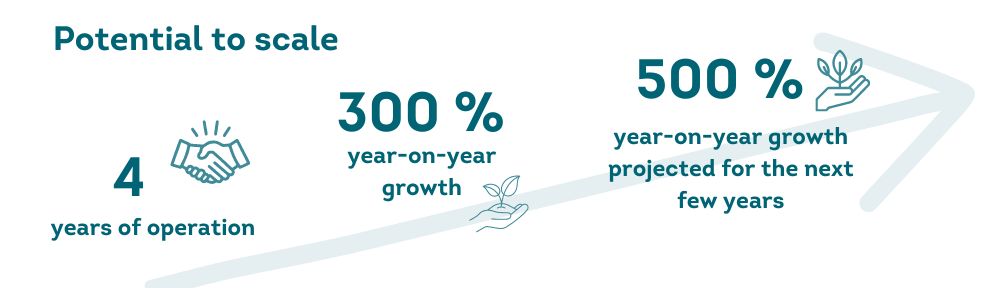

We anticipate increased growth rate given the investments we have made in technology, people and compliance in the past year and we anticipate growth in excess of our current annualized growth rate of 200-300%.

In addition, we have invested a lot into researching the market and making sure that the product is built for the users we are targeting. We have also been able to attract the right kind of partnerships.

What would you need in order to scale?

We need partners to reach certain goals, like increasing the share of women agents. They do not necessarily need to provide cash. As we are targeting micro-merchants, we are looking for partners to deploy technical devices so they can access digital services. We are also looking for people who can train them in financial literacy.

We are also open for equity investments.

What challenges does your company face?

We struggled with attracting the right talent in the technology and banking space and did not immediately get all the partnerships we needed. Funding, too, is a challenge.

Also, low-income communities are expensive to reach. We had to leverage a lot of foot soldiers, who must be trained and equipped. Consumer support is critical, too, because low-income consumers are more demanding. They want to speak to someone rather than talk to a bot and require instant replies through messenger services.

How do you deal with these challenges?

We are still in the process of overcoming them: trying to streamline processes, track the effectiveness of agents, and change the language we are communicating in. In addition, we are looking for partners who are aligned with our goals and do not put profit over everything.

Are there any recommendations you can give to other inclusive business companies?

Getting investors into your company is a deep marriage. If they have a different impact vision from yours, it can totally derail your impact. So, be very particular about the kind of funding partners you are working with.

Also, ensure that you are measuring what is important. Ensure your impact KPIs are clearly articulated and the model for tracking is consistent with what you want to achieve.

The Impact Stories are produced by the Inclusive Business Action Network (iBAN). They are created in close collaboration with the highlighted entrepreneurs and teams. The production of this Impact Story has been led by Susann Tischendorf (concept), Katharina Münster (text, video and info graphics), Christopher Malapitan (illustrations), and Alexandra Harris (editing). The music is royalty free. The photographs are courtesy of Bankly.

Updated: 12/2022.