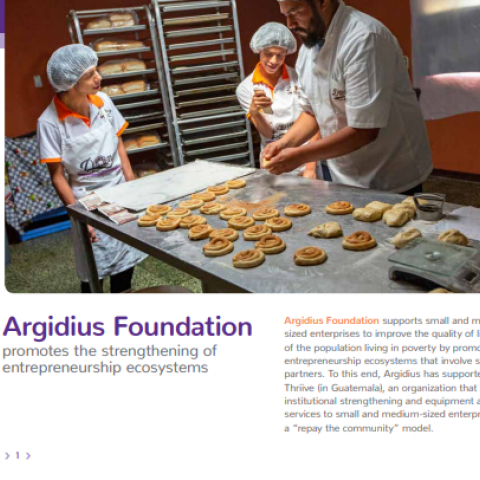

Many entrepreneurs in the informal economy, and the employees that work in those businesses, are often exposed to difficult and dangerous working conditions.

The tools used to identify, prevent and rectify such conditions in the formal economy – including social dialogue between employers and employees, labour inspection and other applications of labour law – generally do not apply to the unregistered enterprises such as the ones cited. Alternative approaches are required to help these entrepreneurs, but what can be done, and how?

New ILO research backs up the idea of reaching and helping these businesses through microfinance institutions (MFIs). Microfinance for Decent Work – Enhancing the impact of microfinance: Evidence from an action research programme was led by the ILO’s Social Finance Programme in collaboration with the University of Mannheim in Germany.

In many emerging markets, MFIs have significant outreach, providing financial services to thousands, if not millions of small and micro enterprises. Since their primary relationship with these entrepreneurs often involves an enterprise loan, they were able to use that leverage to improve conditions in the business.

From 2008 to 2012 the ILO collaborated with 16 microfinance institutions to test a range of approaches to foster social impact through the delivery of innovative financial and non-financial services. Eliminating child labour, fostering the formalization of enterprises, reducing vulnerability and enhancing business performance through improved working conditions – these are decent work objectives that MFIs addressed in the framework of the “Microfinance for Decent Work” (MF4DW) action research programme.

The results highlighted one key message: that MFIs can achieve desired results if they identify an issue and then focus on that area to help their clients.