The base of the pyramid (BoP) has long been recognised as an untapped market, but the question has now shifted to the more complicated how do we tap into it?. Marketing techniques used in the West prove ineffectual and at times impossible to implement in emerging countries, and corporations face difficulty in reaching their target consumers, let alone convincing them to buy their products. This is because inclusive businesses in developing markets apply their own lenses when they design a product or service for the BoP, often biased by the idea that they want to “help,” not “serve,” their customers. Instead, they should focus on what their customers value, which are not cheap products, but risk-free solutions, that prove at least as good as the alternatives on all aspects, and that answer their aspirations.

Assess your customer’s challenges and develop risk-free solutions, not cheap products (your customers will be ready to pay more for those)

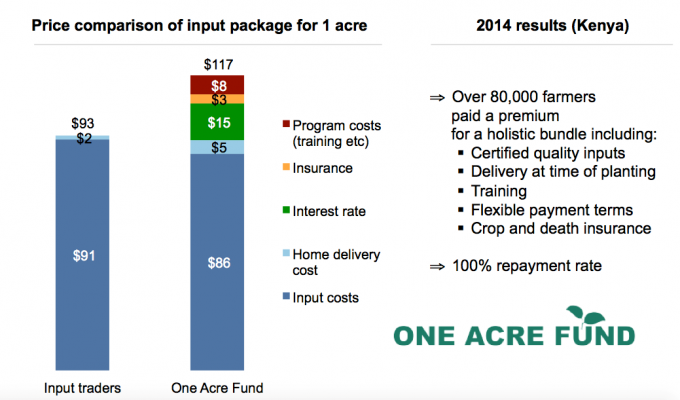

Our research on innovative devices shows that contrary to common belief, low-income customers are willing to spend more for quality products, if they are convinced that these products will deliver the promised benefits. Rather than trying to create the cheapest product possible, this requires understanding all the challenges that target customers face to succeed and creating a “risk-free” offer that overcomes all of those. For example, One Acre Fund, which sells agro inputs on credit to smallholder farmers across Africa, adds over 25% premium over the costs of inputs in exchange for a unique, comprehensive package that makes it as easy and likely as possible for farmers to succeed. They provide training to farmers on best agro practices adapted to their crops, easy payments with mobile payment system M-Pesa, and quality inputs delivered close to the farm just before planting time.

Source: One Acre fund data, Hystra analysis. See “Smallholder farmers and businesses” for more information

Another example is Patrimonio Hoy, a subsidiary of cement manufacturer, CEMEX, selling home improvement packages, one of the few inclusive businesses launched by a large corporation that has reached over 500,000 paying clients (and counting). To design this programme, the project team immersed themselves in a low-income neighbourhood of Mexico to truly understand the predicament their clients faced when trying to improve their homes. Like One Acre Fund, Patrimonio Hoy’s customers are willing to pay a 26% premium over the cost of building materials in exchange for complementary services. This fee pays for services that overcome the risks involved in building an additional room: architect advice on the room design and the amount of material needed, flexible building material deliveries, and fixed, weekly payments with strong penalties to encourage compliance.

Study existing alternatives and make sure you at least match those – on all aspects

The product or service provided must also be at least as good as the alternatives on all aspects, and better on some, to justify people switching products or habits. With nutritious food, for example, this means creating or adjusting products so that they are in line with local tastes, food formats, and food habits. This sounds obvious, but many programmes aiming at proposing more nutritious foods to low-income people insist that people should eat these products purely for their health benefits, in spite of their bad taste or complexity to cook. A mother is not likely to buy a meal, no matter how well fortified, if she faces difficulty in getting her child to eat it. Products must also match local customs so that they can be incorporated seamlessly into customers’ lifestyles. For example, according to our research in nutrition, micronutrient powders have been well received in Bangladesh where women are used to cooking with spices and simply add in the powder while preparing meals. In Africa, successful fortified porridge mimic the name (e.g., “pap” in South Africa) and form (e.g., rice porridge in Madagascar, mixed flours in Rwanda) of traditional porridges. Conversely, in Indonesia, micronutrient powder struggled to take off as pills, not powders, were the expected product form when it came to added vitamins and minerals.

Convenience is also key, e.g., by providing home delivery. Nutrizaza has experimented in selling infant porridge ready-made, warm, at the time of breakfast at mothers’ doorsteps. Doing so increased product uptake tremendously and allowed them to get over 20% of mothers in the area regularly feeding the product to their children (a key point for fortified porridge to yield health impact) – a much higher “high consumption” penetration than when selling the product through retail as a powder to be cooked, which typically gets less than 5% of frequent users among their target population.

Understand your customers’ aspirations – and make sure you target them

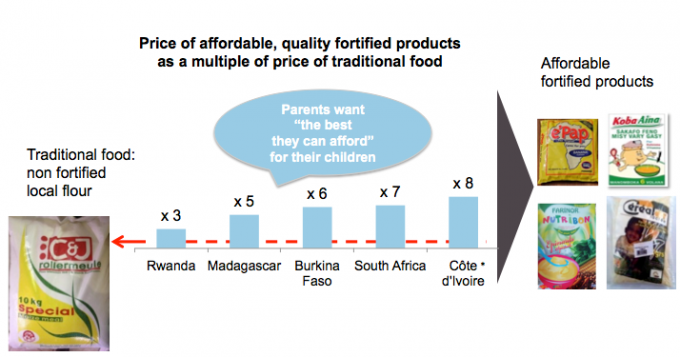

In addition to having the right product, understanding and responding to people’s aspirations is vital to drive sales take-off. One such aspiration for parents is for their children to succeed, and they are willing to go to great lengths to fulfil this aspiration. In Africa, this translates into low-income consumers (socio-economic level C-D) paying 3-8 times more for a fortified porridge for their children than they would for non-fortified flour, as shown on the graph below for a range of brands.

Comparison for 100g of affordable fortified product vs. 100g of local flour

Sources: manufacturer data, Hystra analysis. “Marketing nutrition for the BoP” for more information

Paying a premium is not only linked to aspirations and social status, but also a way to reassure customers on the quality of the product they purchase (answering their concerns about risk described above). For example, Hydrologic, a company that sells water purifiers in rural Cambodia, has seen that when it presents two versions of its water filters to customers, twice as many opt for the slicker $24 model than the entry-price $14 model. While both purify water in the exact same way (the only difference being an elevated base that makes it easier to fill a glass, and a more aspirational look, for the more expensive one), people will go for the premium product to make sure they have done anything they can to truly get safe water – they are too poor to afford a cheap product that might fail.

All of this is to say that, in many different ways, understanding the customer is the only way to create and sell a successful product or service in the BoP. To do so, organizations need to spend time with potential customers early on to understand their pain points, answer those holistically in a first prototype, test those, and refine their offer. The BoP is not a homogenous market. This explains why the so-called “fortune at the base of the pyramid” – to quote the famous C.K. Prahalad book – has not yet been found: the “BoP” is actually a myriad of small markets, each complex to tap into. Customer immersion and later, responsiveness to customer feedback, are the only ways to make sure an organization’s product or service not only meets the requirements of the people they are intended for, but can succeed commercially.