Come together: Inclusive agribusiness and farmer finance need each other

By Fauzia Jamal

When we hear “inclusive agribusiness” we often think about it in terms of supply chain inclusion - when profit-making businesses engage members at the base of the economic pyramid (BoP) as producers, suppliers, workers, distributors, and consumers. But why not think about inclusive agribusiness in terms of both supply chain and financial inclusion? Ensuring access to finance, whether to enable purchase of input, equipment, or end products as consumers, is a second element of support that is key to enabling the inclusive business model.

Supply chains and finance

Integrating smallholders as producers in a supply chain, or as consumers of inputs and equipment, are no doubt important elements to forming inclusive agribusinesses (see Figure 1 below). In building these models, the agribusinesses are solving a key supply constraint, acquiring new customers, and gaining farmers access to the market. For example, AgDevCo investee Rungwe Avocados in Tanzania similarly has integrated 3,500 contracted smallholder farmers as part of its export supply chain and works to improve productivity through input supply and services.

Figure 1: Integration of BoP populations/Smallholder Farmers into Inclusive Agribusinesses

However, to improve quality of supply and production yields, market linkages and technical assistance services are not enough. Without access to finance - whether the smallholders are included in the business model as producers, suppliers, distributors, or consumers - the model is constrained. Farmers have limited ability to invest in high quality inputs or purchase/hire equipment that would improve production volumes or quality. Farmers are also limited in their ability to pay for goods/services as consumers.

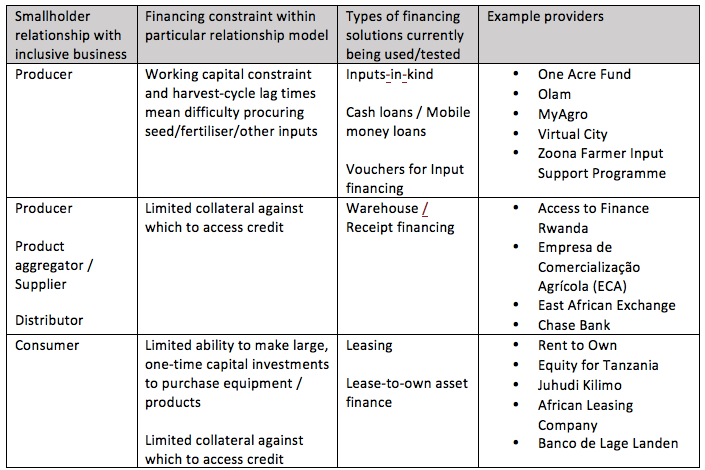

Recognizing this constraint, inclusive agribusinesses are increasingly developing value chain finance models to support the particular need of the smallholder specific to their role (see Figure 2 below). Globally, finance by value chain actors is estimated at USD ~17B annually (see Figure 3 below).

Figure 2: Examples of value chain financing by smallholder integration type

Figure 3: Share of global smallholder lending provided by value chain actors including inclusive agribusinesses (Source: Inflection Point)

However, while a crucial enabler of inclusive business models, and although inclusive agribusinesses are well-positioned to play a financing role, current levels of value chain finance are hardly scratching the surface of financing needed by smallholders (estimated at over 200B USD across sub-Saharan Africa, Latin America, and South and Southeast Asia). Ultimately, inclusive agribusinesses are limited in their ability to fully meet smallholder finance needs by:

- The strength of their own balance sheets and the realistic limits to the financing burden they can carry: The degree to which the cost of support services such as financing inputs, training, etc. is internalized by the agribusiness affects their bottom line and ability to expand off-take agreements etc.

- The competencies and capabilities of the business: Serving as a financier requires a different set of capabilities from the core activities of the agribusiness which has cost and resource implications.

The combination of these two realities means that inclusive agribusinesses simply cannot, in the long term, meet the financing needs of all smallholders. While providing financing is necessary to ensure the productivity and quality of the supply chain, it is not their core business or a profit-making activity.

At the Learning Lab, we are excited to follow two trends in the sector that we believe show strong potential to help mediate this tension and to enable strong inclusive business models that share the financing burden.

Expanding progressive partnerships

The recent landmark report, jointly published by ISF and the RAF Learning Lab, identifies progressive partnerships as a useful way to decrease risk and service costs, distribute remaining cost/risk more effectively, and increase customer reach. These types of partnership, such as those created between financial institutions and value chain actors, leverage the unique strengths of each partner to achieve these goals and add value to all partners over time.

If we consider just financing as an example (though these partnerships can enable other functions as well), a progressive partnership would relieve the financial institution of the cost and burden of loan origination, data collection, etc. The partnership also relieves the agribusiness of the cost of carrying the capital burden on its own balance sheet; rather leaving that to the financial institution. We see many such partnerships emerging – for example, one of the most innovative Tanzania banks works with a consortium of agribusiness partners to reach customers in remote rural areas. With farmer data generated from years of interaction with agribusinesses, they can refine its loan analysis, collect repayments, and support the delivery of technical assistance. In return, the bank bears the full credit risk of providing input and equipment financing, ultimately increasing farmer productivity which benefits both the smallholders and the agribusiness.

Can digital technologies be the tie that binds?

As has been noted elsewhere, digital technologies are unlikely to be a silver bullet – adoption is expensive, roll-out requires trust, and only small pockets of the developing world have deep mobile penetration. However, the applications of technology for farmer profiling, value chain payments, and digitizing information flows, could provide crucial foundations for partnerships to deliver finance.

The applications of digital data in particular to credit scoring has been well documented and is an area that continues to evolve rapidly. MasterCard Foundation Partners that we work with, such as Mercy Corps' AgriFin Accelerate, AGRA's FISFAP, and the Fund for Rural Prosperity (FRP), are actively supporting models that use the kind of data accessible to agribusinesses to expand smallholder lending. They are helping to refine partnership structures, improve algorithms, ensure consumer protections, and align data inputs.

Besides credit scoring, digital technologies are increasingly underpinning progressive partnerships in other ways. Digital platforms can also be used to increase product traceability within the supply chain, to enhance sales and inventory management, and to enable affordable access to input and equipment distribution, as demonstrated by iProcure as well as leading commodities companies. The E-Warehouse programme seeks to provide farmers with agronomic information, training on post-harvest crop handling, and access to credit against their harvested crops using a mobile-based tool for data collection, storage, and analysis. Other players such as Smart Money and BioPartenaire are using mobile platforms to track and facilitate savings and payments to smallholders, improving safety and efficiency of transfers between agribusinesses, farmers, service providers, retailers, and others. Even where these technologies are not directly linked to a financial product, they make it easier for financial service providers to serve smallholders.

Next steps

The Learning Lab will continue its research in these areas in an upcoming "deep dive" study for the FRP, which will follow inclusive agribusinesses (and fintech firms) as they look to develop partnerships with financial service providers, and the extent to which digital technologies help bring these partners together successfully.

Although it is early days, we're excited about the potential to dramatically increase financing to smallholders enabled by inclusive agribusinesses. Ultimately, access to finance will strengthen the business model of the agribusiness itself and increase farmer-level impact.

This blog is part of the July 2016 series from the Practitioner Hub and Seas of Change on Inclusive Agribusiness. Download the PDF for more insight, updates and opinion.