Editor's Choice: February 2011

Impact Investments; an Emerging Asset Class

We all talk about the fact that inclusive business delivers commercial returns, but what level? What percentage? Matching conventional market returns? This report actually provides some answers.

It’s focus is on the investors – not necessarily the entrepreneurs and business owners – who have chosen impact investing (which is defined here as investments intended to create positive impact beyond financial return).

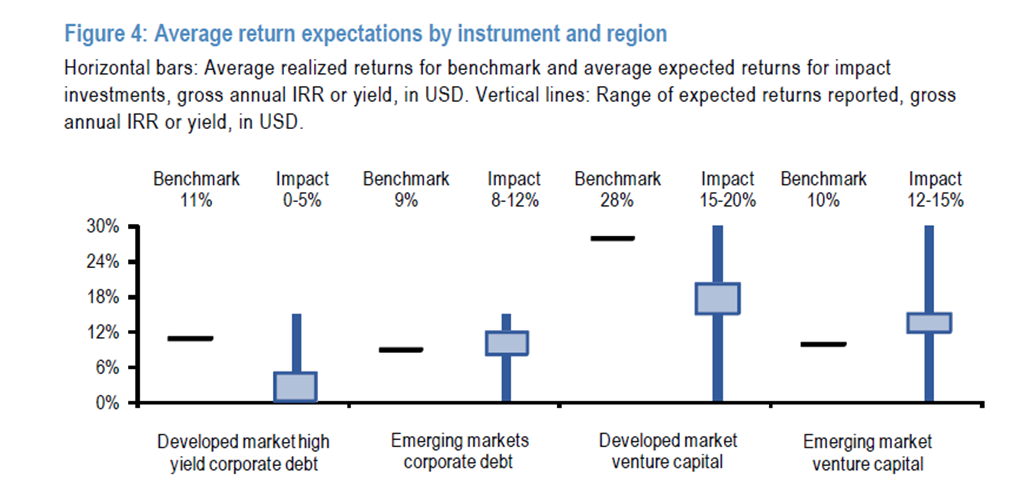

Based on a survey of 24 investors covering 1,100 investments, the authors find reported return expectations vary dramatically from competitive to concessionary. Some expect to outperform traditional investments while others expect to trade-off financial return for social impact. Notably higher returns are expected in emerging markets, and new entreants increasingly believe they need not sacrifice financial return, particularly when focused on base of pyramid consumers.

The report, produced by JP Morgan with Rockefeller Foundation and Global Impact Investing Network, covers much more than financial expectations. In good company with two other 2010 reports on this expanding field, Investing for Impact and More than Money, it covers the terrain from what impact investment is all about, to its variety of impact and the vast market opportunity that remains to be exploited. If it’s new terrain to you, just read pages 7 and 8 and you will know much more. If this is your field, see if you agree with the proposition: that the bundle of characteristics, skills and metrics that have developed over 20 years now argue for the recognition and development of impact investment as a separate asset class.

Source: JP Morgan (2010) Impact Investments, November 2010, p. 10