What future for solar lanterns?

This blog is written by François Lepicard, Simon Brossard, and Adrien Darodes

Solar lanterns have been very popular in emerging markets since 2010, with about 24 million products sold in the past seven years (GOGLA).This success has largely been enabled by the emergence of market leaders, such as d.light and Greenlight Planet, as well as the entrance of electronic and LED device manufacturers, such as Renewit. Together with institutional and corporate supporters, they have overcome key difficulties (national regulatory frameworks, customer awareness of solar, large-scale distribution channels, product diversity, performance and cost) (BNEF). The solar lantern industry has reached maturity and is now well established around the Global Off-grid Lighting Association.

From an energy access perspective, two major questions remain, however, regarding solar lanterns:

- How to reach the complex geographies that are underserved?

- How to ensure that solar lanterns deliver on their promise of creating real economic savings and tangible impact for purchasers?

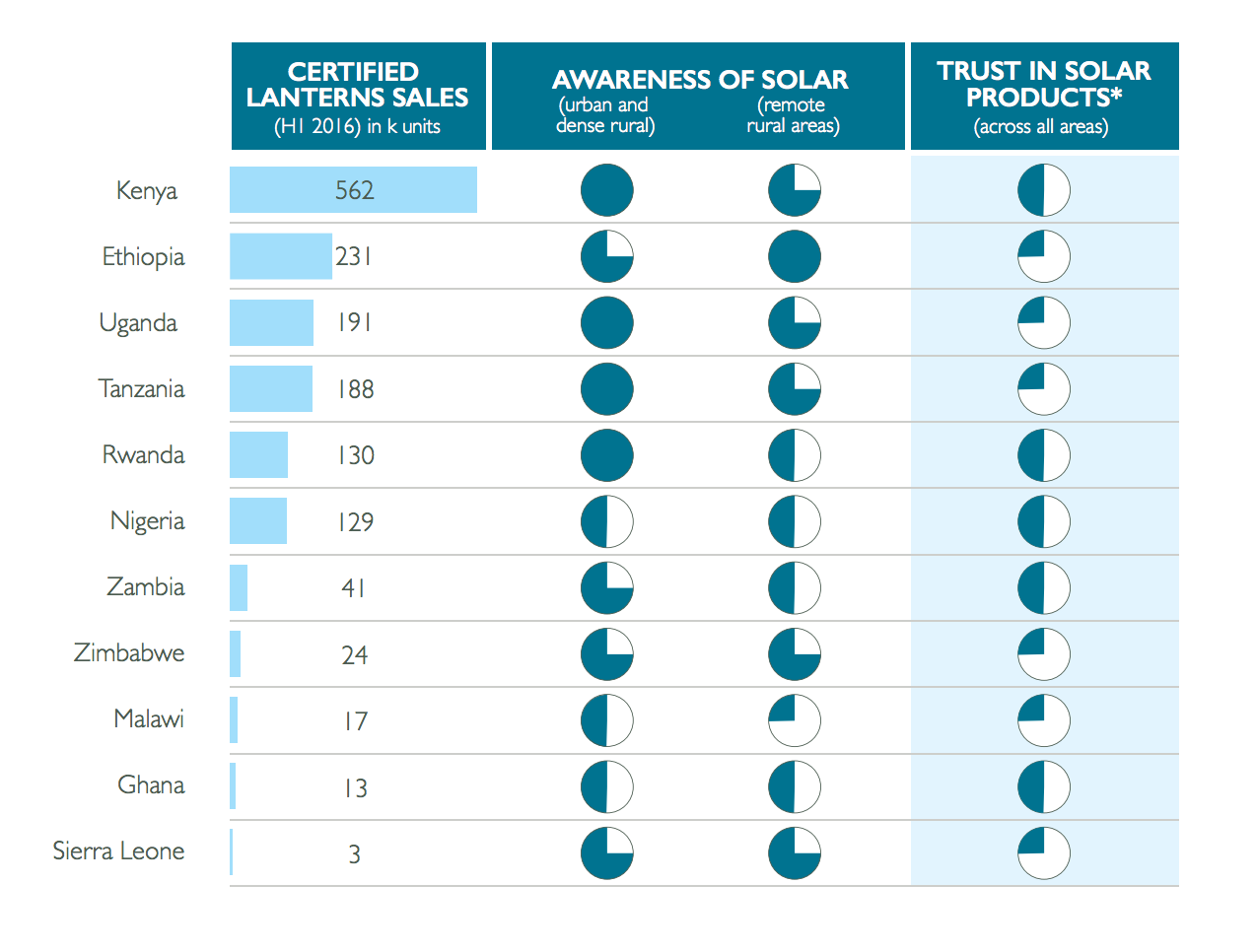

Success has indeed been mostly located in a few densely-populated regions of East Africa and India. Today, five East African countries and densely-populated regions of India still account for 70% of global sales, yet they only account for 35% of the global off-grid population (International Energy Agency, 2015). Sales in West African countries are beginning to pick up, but the region remains largely untapped. Several factors explain this discrepancy, including small off-grid populations, low population densities, less favorable government regulations and higher import tariffs and VAT (ODI, 2016).

Comparison of geographic distribution between quality-verified lanterns and off-grid population

Even within these few successful countries, sales of quality-verified lanterns have been very localized in denser urban and semi-rural areas, which are typically richer, easily accessible by road, and well covered by awareness campaigns (e.g. Lighting Africa, SunnyMoney) (Economic Impact of Solar Lighting, One Watt at a Time, SNV). Sales have been so concentrated that about two thirds of the Western Kenyan core market is estimated to now be equipped with solar lanterns. Overall, sales in the core regions of East Africa are showing signs of saturation.

This localization pattern is also explained by the difficulties met by solar lantern distributors to reach the broader rural, less accessible areas. There, the main issue remains the lack of adequate distribution channels, where the traditional direct sales model is unsustainable for entry-level products, and where partnership models (e.g. cooperatives, MFIs) have only met local successes.

Distributors of quality-verified lanterns also struggle to differentiate against the surge in cheap copycats, which do reach even the most remote areas through informal channels and bulk distribution (ODI, 2016 Ethiopia Report), and offer ultra-affordable but low-quality products without any customer service. Although manufacturers of quality-verified products comply with warranty requirements, customers often have several broken products stacked at home and resort to informal repair or unsustainable disposal.

These trends largely contribute to low consumer trust levels in solar lanterns. While awareness of solar has never been so high in Sub-Saharan Africa, lanterns are increasingly seen as cheap commodities failing after a few months, and therefore unworthy of significant investment.

Comparison between consumer awareness and trust in solar products by country in

Sub-Saharan Africa (ODI (2016), Country briefings)

To ensure the continued success of the solar lanterns industry, practitioners will need to address these rising manufacturing and distribution issues. To access larger customer segments, they will need to reinvent their business and distribution models, e.g. by relaunching direct sales models in rural areas, with higher, tactically determined pricing (which may affect product mix, e.g. focus on higher-end lanterns and small SHS that can better ‘absorb’ high sales commissions). To successfully scale up their operations in new geographies (West Africa), they have the opportunity to leverage donor-based initiatives (e.g. result-based financing), including advocacy and lobbying against lack of cash and high VAT and import tariffs.

But beyond customer reach, the solar lantern industry as a whole needs to focus on customer care. This will indeed require industry-wide cooperation, on product sourcing, distribution and customer service before and after the sale. In this regard, donors and investors supporting the industry have two major opportunities in front of them: (i) initiating a multi-brand aftersales utility to share maintenance and logistics costs among multiple players, and (ii) setting up a central buying platform for local distributors providing financial and technical support.

Want to know more? Check out the full Hystra report here (not longer available)

This blog is a part of the July 2017 series on energy access in partnership with Hystra.

Read the full series for more lessons from practitioners, trends in business models, market penetration and understanding and measuring impact in the energy sector.

More information:

- Lighting Global, GOGLA (2015 H2, 2016 H1, 2016 H2), Global Off-Grid Solar Market Reports: Semi-Annual Sales and Impact Data

- BNEF, Lighting Global (2016), Off-Grid Solar Market Trends Report

- International Energy Agency (2015), World Energy Outlook

- ODI (2016), Country briefing

- Adina Rom (ETH), Isabel Günther (ETH) and Kat Harrison (Acumen) (2017), The Economic Impact of Solar Lighting: Results from a randomized field experiment in rural Kenya

- Jechoniah Kitala (SNV), One Watt at a Time: The Rise of Solar Lighting in Rural Kenya, SNV Annual Report Appendices 2015.

- ODI (2016), Ethiopia Report

- Solar and other stories (no longer available)