Econome

Econome crosses the last mile to distribute home utility products like solar lighting, clean cooking and grain storage facilities to rural households in Kenya. In doing so, the company creates income opportunities for female sales agents.

To start, could you briefly introduce yourself?

I am Linda Wamune, Founder and Managing Director of Econome Kenya. When I started the company, I had been doing last mile distribution in the clean energy for over ten years. Customers kept asking me what else I could provide.

Could you also briefly describe Econome?

I founded Econome in late 2018. We cross the last mile and distribute home utility products like solar lighting, clean cooking and grain storage facilities to rural households in Kenya. In doing so, we create income opportunities for female sales agents. Our mission is to become a trusted partner providing easy access to a variety of quality, affordable home utility goods in rural areas.

What is the special value you create for consumers?

We offer high-quality products at affordable prices and with flexible payment terms. Based in rural areas, we sell a variety of products under one roof, close to consumers. This enables us to build trust and support customers if there is an issue with the products. Being locally anchored is crucial for Econome. Alternatives to our service exist but have their drawbacks. Products from local retail outlets are often of poor quality, while specialized distributors demand upfront payments or focus on one single product line only.

How do you measure the impact you create?

We say that our products save consumers time and money. An efficient cook stove, for instance, take less time to heat and saves costly fuel. Hence, we have three main metrics: the number of hours saved by using our product, the amount of money saved, and the number of people impacted – which we calculate based on the number of products sold.

So, how many people do you reach?

Up until now, we have sold about 9,000 products, benefitting 40,000 people. According to our estimates, customers have saved 918,000 dollars and 551,000 hours in the last two years by using our products.

What makes your business model commercially viable?

Our annual revenue in 2019 and 2020 was $150K dollars. We meant to break even this year, but the pandemic stopped us. Rural households in Kenya saw their incomes drop and had to prioritize food over durable goods. This impacted our performance.

Now, our goal is to generate a revenue of at least one million dollars in five years’ time. We have pulled all the building blocks together: an efficient group sales system, a great team and a cost-efficient human resources policy making use of local capacity. Now, we need to increase the sales volume while monitoring costs. Our products cost 25 dollars on average. With a target gross margin of 35 per cent, we must sell 875 units per month to break even.

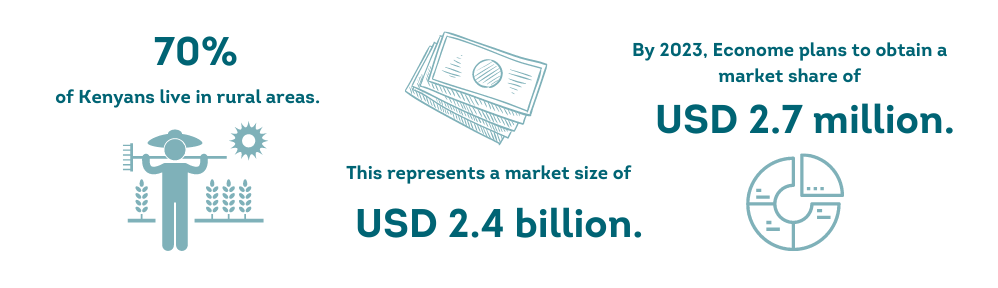

We serve a huge market, so this is a realistic goal. Seventy per cent of Kenya’s population live in rural areas. This is a market of 2.4 billion dollars. Within the next three years, we plan to obtain 2.7 million dollars of that market. After that, we may expand within the region. According to the Africa's consumer market potential report, African households spend 20 billion dollar per year on household utility goods.

How are you going to expand your company’s reach?

We have started to focus our outreach on women and youth groups. For this, we are piloting a digital group sales model, which we developed partly in response to the Covid-19 pandemic. Engaging with groups is more cost effective than engaging with individual clients, and the move online will help boost our resilience.

Could you say more about the digital group sales model?

We have developed a mobile app to simultaneously digitise group sale and lending. The app’s algorithm calculates the credit worthiness of group members. After that, they can select products and submit a loan request. In December, we won an award by the Global Distributors Collective (GDC) that will help us finance the pilot.

What kind of investment do you need to realize your plans for scaling?

We are mainly looking for blended capital to avoid taking on expensive debts. Equity investments are hard to come by for small local businesses but would be very welcome, too. We would also like to cooperate with larger companies through their CSR initiatives. Our target is to raise 200,000 dollars within two years.

Apart from the pandemic, what challenges has Econome overcome?

The biggest challenge was a lack of funds and I had to dig deep into my own pockets, but I know that our customers and sales agents rely on Econome, so I cannot let them down.

Reaching our consumers is a challenge, too. Last mile distribution is expensive and difficult logistically and to keep prices down for consumers, we allow sales agents to order in bulk. We would also love to adopt online shopping to make the process even more efficient. In addition, many customers lack knowledge of our products, so we are developing video explanations, which are more effective than one-time demonstrations on site.

What are your recommendations for other inclusive business leaders?

The biggest challenge is access to finance, especially for local businesses. To start off, you must have your own money. Establishing an inclusive business is a big sacrifice. You need to know you are in for a tough ride, so belt up and be prepared for the turbulence. Absorb the shocks, learn from them, and carry on. Once you have your vision, just keep building it and do not give up.

The Impact Stories are produced by the Inclusive Business Action Network (iBAN). They are created in close collaboration with the highlighted entrepreneurs and teams. The production of this Impact Story has been led by Susann Tischendorf (concept), Hong Anh Dao (video), Katharina Münster (text and infographics), Christopher Malapitan / Lena Jukna (illustrations), and Alexandra Harris (editing). The music is royalty free. All photographs are courtesy of Econome.

Updated: 05/2021.