Performance of agribusinesses projects in BIF: solid performers? Or weaker than other sectors?

The Business Innovation Facility now supports over 40 inclusive businesses with technical assistance in what we call ‘long projects’. Within this portfolio, more than half involve businesses in agriculture or food. We have therefore reviewed our core monitoring data in order to understand how businesses in agriculture and food are doing.

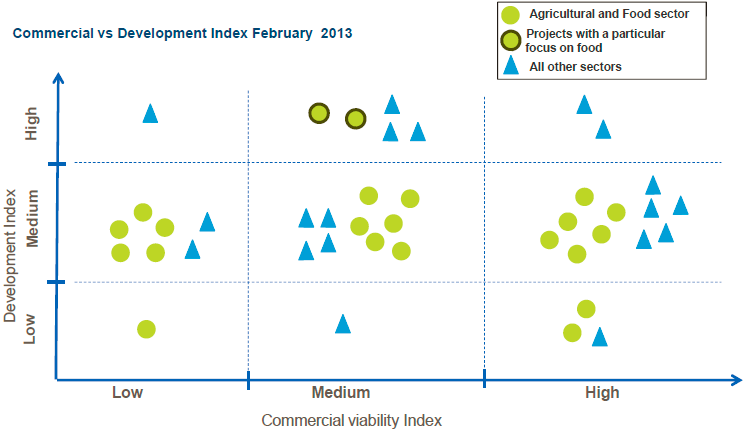

In the graph on the left, green dots represent BIF-supported businesses in agriculture and food, plotted against two axes: our development index (potential for impact at the base of the pyramid) and our commercial viability index (potential to achieve commercial viability and sustainability). As you can see, the green circles are well spread across the range of high medium and low.

The good news is that there is a solid concentration of green in the categories that are medium development impact and medium or high commercial viability. This is a good recipe for secure and sustainable delivery of results.

Aside from the diverse pattern and solid core, there are three other interesting points to draw from this graph. Firstly, several of the agriculture and food businesses score high on the viability index (x-axis) but few score high on the development index (Y-axis). Secondly, the two that do score high on the development index are the two that are in food: their inclusive business model is not about sourcing crops or livestock from farmers, but rather selling nutritious food to BOP markets. Thirdly, when comparing them to projects in other sectors – represented by the blue triangles, we can see that both sets are well spread across the matrix. But the other sectors are scoring slightly better: more projects that are high on development, and proportionately fewer that are low on viability.

Fewer high scores on the development index in agriculture: Is this a reflection on agriculture projects or on our methodology and scoring system? We cannot be sure.

The vast majority of the agriculture and food projects are engaging with BOP producers, however, not all of them. As the top row of the table on the right shows, there are a handful that are categorised as consumer focused. But method does matter, particularly how we score scale, and how a focus on BOP producers or consumers affects scale. Projects that engage the BOP as producers - suppliers of cassava or cattle – tend to reach some hundreds or thousands of people. In contrast those that sell energy or fertiliser may reach tens or hundreds of thousands of BOP consumers. Although we have adapted our scorings of what counts as ‘high scale’ for producer-focused and consumer-focused projects, it still seems hard for producer projects to really score highly.

The vast majority of the agriculture and food projects are engaging with BOP producers, however, not all of them. As the top row of the table on the right shows, there are a handful that are categorised as consumer focused. But method does matter, particularly how we score scale, and how a focus on BOP producers or consumers affects scale. Projects that engage the BOP as producers - suppliers of cassava or cattle – tend to reach some hundreds or thousands of people. In contrast those that sell energy or fertiliser may reach tens or hundreds of thousands of BOP consumers. Although we have adapted our scorings of what counts as ‘high scale’ for producer-focused and consumer-focused projects, it still seems hard for producer projects to really score highly.

The table shows the same breakdown for the other sectors, where the reverse is true: the majority of projects engage the BOP as consumers.

Finally, the colour of the dots in the matrix indicates how high the projects rank in both the Development and Commercial Viability Indices (see colour-matrix on the left).

What is noticeable is that consumer-focused projects are performing strongly in the food sector as well as in the rest of the BIF portfolio. But none of the strongest performers (the darkest blue dots) are producer-focused, and the majority of the darker coloured dots fall in the 'consumer focus' quadrants.

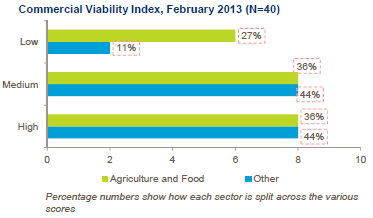

Low scores on the commercial viability index in agriculture: over a quarter of all agriculture projects (6 of them) show a score of low, compared with only 11 per cent of non-agriculture projects, as shown in the bar graph below. Three of these agribusiness projects are however run by large, established organisations. The companies are certainly sustainable but the new IB model is not yet established and is at an early stage. It will be interesting to see how these indicators develop over the coming months, while projects mature and they become more integrated with the rest of the lead businesses (in fact one has already made good progress since these rankings were done).

Low scores on the commercial viability index in agriculture: over a quarter of all agriculture projects (6 of them) show a score of low, compared with only 11 per cent of non-agriculture projects, as shown in the bar graph below. Three of these agribusiness projects are however run by large, established organisations. The companies are certainly sustainable but the new IB model is not yet established and is at an early stage. It will be interesting to see how these indicators develop over the coming months, while projects mature and they become more integrated with the rest of the lead businesses (in fact one has already made good progress since these rankings were done).

These results, although interesting, should be taken with a pinch of salt as the underlying data was collected in January 2013, when most of these projects were still in the earlier stages of their lifetime. We are looking forward to finding out how these results progress over the next few months, while we gather more data and wrap up our M&E findings.

If you would like to have a look at the full analysis please click here

-----------------

Definitions

- The Commercial Viability Index provides an indication of how robust the Inclusive Business is. The indicator looks at current financial performance and what the expectations are for the future

- The Development Index on the other hand looks at the impact of the project on the Bottom of the Pyramid and the potential for replication of the Inclusive Business project.